Should You Close Old Credit Card Accounts?

Having open – but unused – credit cards can seem like a waste of time and money. After all, why keep a credit card that you don’t want? So, should you close your old credit card accounts or keep them open? Here is what you need to know:

What Happened When You Close a Credit Card Account?

Closing a credit card account can have a significant impact on your credit score. When you remove an existing credit account from your credit file, you might simultaneously lower your average age of credit while raising your credit utilization.

Credit Utilization

Credit utilization is the second-largest contributor to your FICO credit score after payment history. And since FICO is the most common score used by lenders, it’s critical to track how specific actions can harm – or help – your credit score.

When you close a credit card account, the overall amount of credit you have decreases (more on that later). For example, if you have two card accounts with a $5,000 limit each, you’ll have $10,000 in available credit. Closing one of those accounts will leave you with just $5,000 in available credit.

If one account has a $2,500 balance and the old, unused account has no balance – that would give you a credit utilization rate of 25% – below the 30% experts recommend for maintaining a healthy credit score. Closing the unused account will increase that credit utilization rate to 50%, however, seriously impacting (and dropping) your score.

Average Age of Credit

Closing an old credit card account will also decrease the average age of your credit accounts. The average age of accounts has less impact on your FICO score (accounting for about 15% of what makes up a FICO score) but can still lower your credit health in the short term.

When Should You Close Old Credit Card Accounts?

Closing a credit card account makes perfect sense under certain circumstances:

The Card Has an Annual Fee

If your unused credit card has an annual fee, it might be worth closing the account despite the short-term hit to your credit score. While credit card annual fees vary, some cards, like the Chase Sapphire Reserve, have yearly charges that can run into hundreds of dollars. If you are not getting the value for the perks offered, consider closing the account to save money.

You Have Multiple Accounts with the Same Lender

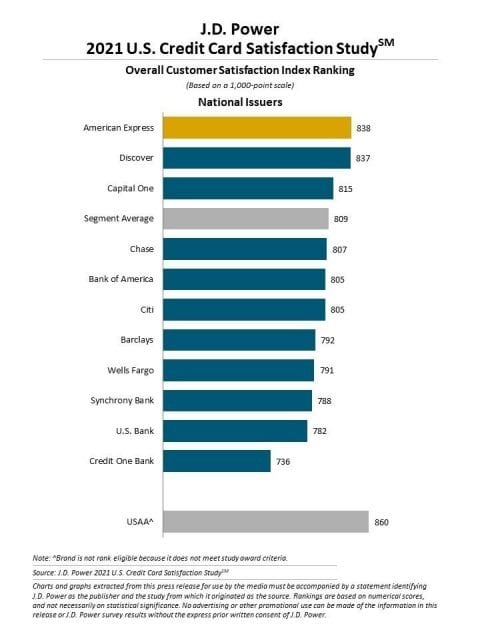

If you have several credit cards with the same issuer, you might be able to close one account and not hurt your credit score. Some issuers, like Barclays, Chase, and American Express, allow customers to transfer their credit lines from one card account to another.

If you have multiple cards with your bank, contact customer service to discuss transferring your current credit line and closing the unused account. This process will see the average age of your credit accounts lower but will not impact your credit utilization. You might even be able to downgrade from a card with an annual fee to a no annual fee version without sacrificing your rewards points.

Conclusion

In many cases, keeping old credit card accounts open is an easy way to keep credit utilization down and your credit score up. However, closing old accounts can make sense – and be done correctly without harming your credit health. Before you close any credit card, make sure to investigate how that closure will impact your FICO score. If possible, contact your card issuer and discuss switching credit lines to other card accounts, but never hold on to an unused credit card if the fees associated with the account are more expensive than the value the card provides.

Related Article: Will Paying Off Credit Cards Hurt Your Credit Score?