Last updated on April 2nd, 2024

Co-branded credit cards exist for almost every type of retail merchant, including grocery stores and wholesale clubs. Before you apply for your next credit card, make sure you understand all the ways to maximize your rewards with grocery store credit cards.

Table of Contents

At a Glance

- Co-branded grocery store credit cards are a great option to consider if you frequently shop at one chain and know how to maximize your savings with every trip.

- If you live in a more rural location, services like Amazon Fresh and Walmart+ provide significant value for money when paired with the correct rewards credit card.

- Credit cards that focus on delivery services like Uber Eats, Instacart, and DoorDash are great if you aren’t brand-loyal and live in a big city, as these services typically cover other areas of business, including retail, home, and pet supplies.

- Always ensure you read the terms and conditions of your credit card rewards program and any loyalty programs you may join. Fully understand all aspects of the rewards scheme, the program’s limitations, and how to best streamline your spending habits to maximize your earnings.

What are Credit Cards for Groceries?

The term “grocery credit card” is vague, as it can apply to any credit card that earns points or offers discounts at grocery stores. Because of this broad definition, everything from the Chase Sapphire Reserve and American Express Gold Card to the Revvi Card fits this description.

For the sake of this guide, we are defining a grocery credit card as any card that is co-branded with a grocery store brand or with another retailer that provides grocery deliveries. While this guide excludes everyday cash back credit cards like the Citi Double Cash Card or the Chase Freedom Flex, it helps to better study these brand-specific credit card offers.

Other Rewards Cards with Grocery Store Benefits

Because the definition of grocery credit card is fairly strict in this article, it is worth noting some of the best cash back and general rewards credit cards for grocery store purchases that are currently available. Almost every major issuer has an everyday rewards credit card that earns on categories like dining, travel, and groceries.

Here’s a quick overview of our top picks for the best everyday credit cards for buying groceries:

Citi Custom Cash℠ Card |

American Express® Gold Card |

U.S. Bank Cash+® Card |

Blue Cash Preferred® from American Express |

Related Article: The Best Credit Cards for Grocery Shopping

The Pros and Cons of Grocery Credit Cards

Like any other type of rewards credit card, cards for groceries have great features and also disadvantages. On the good side, most grocery credit cards feature no annual fee and earn rewards on other “everyday” categories like dining, travel, streaming, and more. And since almost everyone buys groceries weekly, it’s an easy way to rack up rewards fast.

The main drawback with grocery credit cards is that they often have exclusions for the biggest stores. Large retailers like Target, Walmart, BJ’s, and others are often blocked from “grocery store purchases” category. This omission can make earning rewards on groceries at these locations difficult – unless you have a card that is co-branded with that particular chain.

These cards also sometimes feature caps on rewards. These restrictions typically apply to more lucrative earning rates, such as for fuel purchases at gas stations connected to supermarkets. Always read the terms and conditions for your credit card before applying – this can help ensure you don’t miss out on any bonuses you may be due.

What to Look for in a Grocery Rewards Credit Card

Deciding on the best grocery store credit card for your family is like picking the juiciest apple from an orchard. With the abundance of options out there, it’s essential to consider various factors before you take a bite. Here are some of the most important things to look at when evaluating a rewards credit card for groceries:

| Feature | Explanation | ||

|---|---|---|---|

| Availability | Check to see if your local grocery chains have their own credit cards. Some cards may be limited to specific regions or grocery chains, so ensure that the card you’re eyeing is accessible at your favorite local supermarket. If not, you might be better off with a basic cash back rewards credit card. | ||

| Rewards | Look at the rewards categories offered by the credit card. While your primary focus is groceries, some cards offer bonus rewards on other spending categories, like gas, dining, or travel. If you frequently spend on other things besides groceries, a card with versatile rewards can really sweeten the deal. Choose the card that aligns with your preferences for rewards redemption. | ||

| Welcome offers | Keep an eye out for introductory offers. Many grocery store credit cards entice new customers with juicy welcome bonuses, like additional cash back on initial purchases or a generous stash of reward points. Just be sure to review the terms and conditions, such as spending requirements or time limits, to make the most of these promotions. | ||

| Annual fee | Always aim to avoid an annual fee on a good everyday rewards card. That’s not to say that a grocery card with an annual fee is bad – far from it. Doing the math on your average monthly grocery expenses will help you see which card gives you the most bang for your buck. | ||

What’s the Best Grocery Credit Card Based on Your Location?

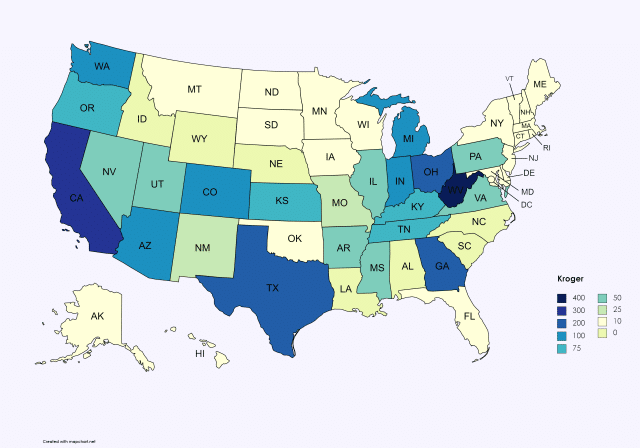

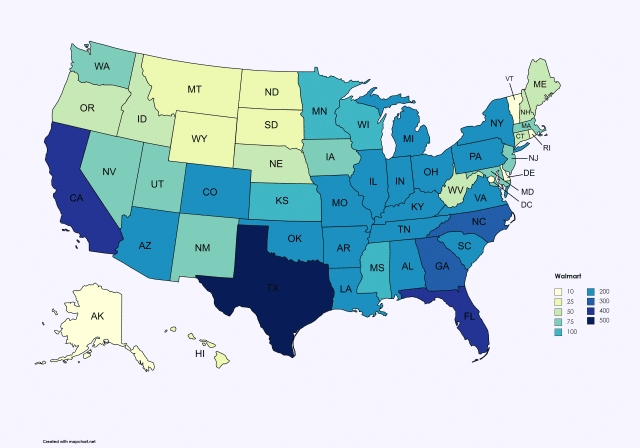

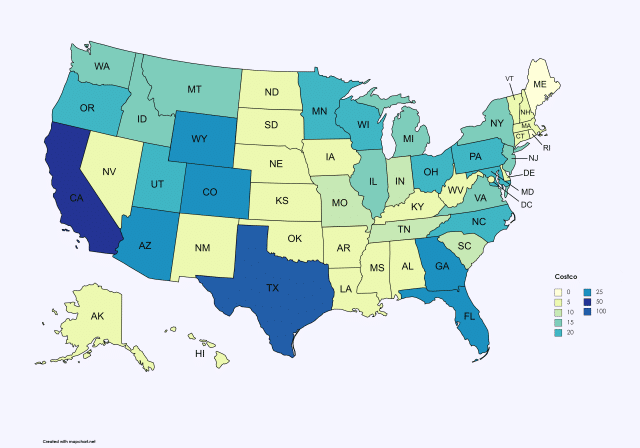

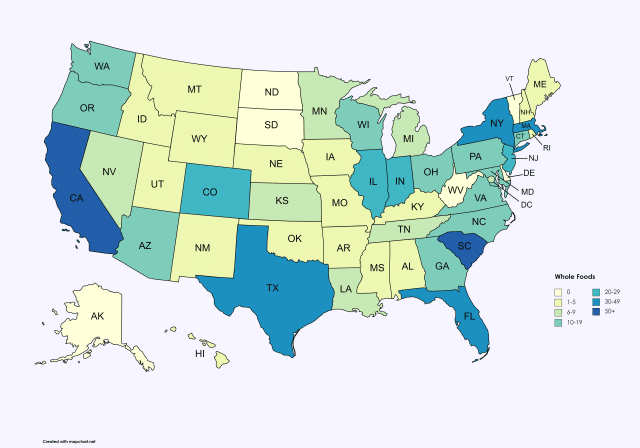

With so many different grocery store brands across the United States, choosing a co-branded grocery credit card can seem like a puzzle. But it makes to start by considering both the stores you shop at most frequently and the stores that are most common in your area. Here’s how the major grocery credits cards stack up geographically:

And here’s the same data on locations from the map in a table format:

| wdt_ID | State | Kroger | Walmart* | Costco | Whole Foods |

|---|---|---|---|---|---|

| 1 | Alaska | 0 | 9 | 4 | 0 |

| 2 | Delaware | 0 | 10 | 1 | 0 |

| 3 | North Dakota | 0 | 17 | 2 | 0 |

| 4 | South Dakota | 0 | 17 | 1 | 0 |

| 5 | Vermont | 0 | 6 | 1 | 0 |

| 6 | West Virginia | 46 | 44 | 0 | 0 |

| 7 | Idaho | 14 | 27 | 7 | 1 |

| 8 | Iowa | 0 | 69 | 4 | 1 |

| 9 | Maine | 0 | 25 | 0 | 1 |

| 10 | Mississippi | 32 | 86 | 1 | 1 |

Given all this, we can try to sum up an “ideal” grocery store card for each state. Here’s the breakdown:

| wdt_ID | State | Best Card |

|---|---|---|

| 1 | Alabama | Sam’s Club® Mastercard® |

| 2 | Alaska | Instacart Mastercard® |

| 3 | Arizona | Smith’s REWARDS World Mastercard® |

| 4 | Arkansas | Sam’s Club® Mastercard® |

| 5 | California | Instacart Mastercard® |

| 6 | Colorado | King Soopers REWARDS World Mastercard® |

| 7 | Connecticut | Prime Visa |

| 8 | Delaware | Prime Visa |

| 9 | Florida | Capital One® Walmart Rewards™ Card |

| 10 | Georgia | Capital One® Walmart Rewards™ Card |

These choices were decided by weighing the number of physical locations of each market per state, along with other considerations such as urban vs. rural communities, transportation links, and more. We have also carefully considered the merits of each program and how those merits compare with other competitive cards.

What’s the Best Service for Grocery Delivery?

One of the easiest ways to rack up grocery rewards is by ordering your goods through a service – be it the store’s own delivery service or a third-party provider. This process lets you bypass merchant coding issues that disqualify bigger box stores like Target, Walmart, Sam’s Club, and more. Here are comprehensive guides for some of the biggest grocery delivery services that provide credit cards rewards.

Kroger

Kroger is one of the largest grocery brands in the United States, with over 2,700 stores across its various brands. Like many large supermarket chains, Kroger offers various goods and services, including groceries, bakery items, prescriptions, and more.

Why Choose Kroger for Your Groceries?

Kroger, while a supermarket and not a box store brand like Walmart or Costco, offers free grocery deliveries should you reach a minimum spending threshold. Buy at least $35 in groceries, and you’ll qualify to have it sent over to you at no extra charge.

Even better, Kroger’s grocery delivery service is actually cheaper than Instacart’s across the board. The prices in the Kroger app or at Kroger.com are the same online as they are in-store. By comparison, Instacart prices are sometimes 20% higher than store prices as stores try to recoup all the fees associated with Instacart deliveries.

Where Is Kroger Grocery Delivery Available?

While Kroger is a nationwide company, it does not have a presence across the entire United States. Some 20 states don’t have any Kroger locations, with most stores scattered across California and the Pacific coast, Texas, the Midwest, and other regional hotspots. There may be other limitations with Kroger grocery deliveries, such as:

- Less availability to people in rural communities

- Reliance on few locations, meaning you might struggle to get in-demand or hard-to-find items.

- High delivery fees if you don’t meet the $35 minimum spending threshold. Kroger charges a $9.95 to $11.95 delivery fee.

Kroger Credit Cards

The Kroger Family of Brands consists of many different grocery chains, like Kroger, Pick N’ Save, Ralphs, and more. With all that variety, you would expect a unifying credit card across all brands. That’s sort of the case, but there are more nuances than that.

Kroger currently offers ten co-branded credit cards issued by U.S. Bank. These cards all feature the logo of the particular Kroger brand and offer specialized rewards and welcome offers based on your location. Here are the Kroger Family of Brands credit cards from U.S. Bank:

Kroger also offers a co-branded prepaid debit card with U.S. Bank. This prepaid card also earns rewards on Kroger purchases without needing a credit check. Cardholders earn 3X points on Kroger Family of Brands own brand purchases, 2X when shopping at any Kroger-owned chain, and 1X points on all other purchases. The card is available either through the Visa or Mastercard network.

How to Save Even More with Kroger

Kroger makes a lot of sense for grocery delivery if you live within the service area and you plan to maximize your savings. There are plenty of ways to increase your value for money with Kroger, including the following:

Get the Kroger App

Just like Kroger’s credit cards, each of Kroger’s various brands has its own unique mobile app. Get the local version (available in the Apple App Store and Google Play), and you can manage all aspects of your Kroger life in one place. The app lets you create shopping lists, check the status of your prescriptions and more. You can even access digital coupons, activate special bonus cash back categories, and, of course, order groceries.

Save More at the Pump

Kroger operates not only supermarkets but also fuel stations. The Kroger Fuel Points program makes it easy to save money on something else that significantly impacts family budgets — filling up your gas tank. Every dollar you spend at a Kroger store is normally worth one fuel point. There is no limit to how many points you can earn, but remember that points reset every month, and you can only use points for up to 35 gallons of gas.

Walmart

Few brands in America are as omnipresent as Walmart. Walmart is a multinational retail giant that operates a chain of supercenters, discount department stores, and grocery stores in the United States, Canada, and the United Kingdom, among others. These services include retail goods, bulk orders, prescriptions and other medical services, and groceries.

What are the Benefits of Walmart Grocery Delivery?

One of the biggest benefits of Walmart is the sheer scale of its presence across the United States. Every U.S. state features at least one Walmart location, meaning you likely have access to Walmart+ and Walmart’s best features in your location.

Walmart+

Walmart+ is $12.95 per month, although Walmart provides a one-month free trial and often provides membership discounts. For that membership fee you gain access to several additional services, including:

- Online Ordering: Customers can place grocery orders through Walmart’s website or the Walmart app. They can add items to their virtual cart, choose a delivery time slot, and proceed to checkout.

- Deliveries: For Walmart+ subscribers, eligible grocery orders can be delivered as part of the membership benefits without an additional delivery fee, assuming they meet any order minimums.

- In-Store Pickup: Customers can also choose the option to pick up their groceries from a nearby Walmart store at a scheduled time. This service, known as “Walmart Grocery Pickup,” allows customers to avoid delivery fees and interact with a Walmart associate who would bring the groceries to their vehicle.

- Paramount+: Walmart+ members receive a complimentary Paramount+ Essential Plan Subscription.

Non-Walmart+ members can also order groceries for pickup or delivery, but these purchases may incur additional fees. It’s also worth noting that if you have The Platinum Card from American Express you can receive monthly statement credits for the service’s $12.95 fee – meaning you essentially get free Walmart+ as long as you remain a cardmember.

Where Is Walmart Grocery Delivery Available?

Walmart grocery deliveries are available in all 50 U.S. states. Despite this, some states have a much smaller representation of Walmart and Sam’s Club (which is owned by Walmart) than others. For example, the southeastern United States has far more Walmart and Sam’s Club locations than the Great Plains.

Walmart Credit Cards

Walmart currently issues a co-branded credit card through Capital One Bank, the Capital One® Walmart Rewards™ Card. That card provides Walmart shoppers with competitive buying power within the Walmart brand and impressive flexibility in points redemption.

Capital One® Walmart Rewards™ Card

Capital One® Walmart Rewards™ Card

Capital One® Walmart Rewards™ Card

- 17.99% or 29.74% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 17.99% or 29.74% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.74% variable based on the Prime Rate Cash Advance APR

At a Glance

Capital One has partnered with one of the world’s top retailers to bring shoppers the Capital One® Walmart Rewards™ Card. Boasting up to 5% back on Walmart purchases (including those from the online site, the Walmart app, Walmart delivery services, and Walmart gas stations) shoppers can enjoy additional savings on already low prices and redeem their earnings towards future purchases, statement credits, gift cards, or travel.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Unlimited 5% back at Walmart.com including Grocery Pickup and Delivery

- Unlimited 2% back at Walmart stores and at Walmart and Murphy USA Fuel Stations

- Unlimited 2% back at restaurants and on travel

- Unlimited 1% back everywhere else Mastercard® is accepted

- Points never expire

- No annual fee

- No foreign transaction fee

- Regular Purchase APR: 17.99% or 29.74% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 17.99% or 29.74% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: 3% of each transfer at the promotional APR. None for balances transferred at the regular transfer APR

- Cash Advance APR: 29.74% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 3% of the amount of each cash advance, whichever is greater

- Late Payment Penalty Fee: Up to $39

- You primarily shop at Walmart for your groceries or household items

- You shop frequently, but not enough to warrant a wholesale club membership

- You want rewards for travel and dining

- You have a good or excellent credit score

- You prefer a Walmart credit card to a store card or a Walmart MoneyCard debit card

- You want a card with no annual fee

There is another Walmart-family credit card issued by Synchrony Bank, the Sam’s Club® Mastercard®. While Sam’s Club isn’t the same as Walmart, it is owned by the same parent company. Because of this, Sam’s Club cardholders can use their Mastercard at Walmart locations to enjoy 5% back on purchases.

Sam’s Club® Mastercard®

Sam’s Club® Mastercard®

Sam’s Club® Mastercard®

- 20.9% or 28.9% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 20.9% or 28.65% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 25.90% or 31.65% variable based on creditworthiness and the Prime Rate Cash Advance APR

At a Glance

The Sam’s Club® Mastercard® offers Sam’s Club members everywhere up to 5% cash back on gas purchases, 3% back on dining, and more – all for no annual fee. From Synchrony Bank, the card also features no foreign transaction fees, Mastercard’s near-global acceptance, and special savings when shopping at Sam’s locations nationwide.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 5% cash back on gas anywhere Mastercard is accepted (on first $6,000 per year, then 1%)

- Earn 3% cash back on Sam’s Club purchases for Plus members. Club members earn 1% cash back

- Earn 3% cash back on dining and takeout

- Earn 1% cash back on other purchases at Sam’s Club and wherever Mastercard is accepted

- No annual fee

- Regular Purchase APR: 20.9% or 28.9% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 20.9% or 28.65% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 4% of the amount of each transfer, whichever is greater

- Cash Advance APR: 25.90% or 31.65% variable based on creditworthiness and the Prime Rate

- Cash Advance Transaction Fee: Either $5 or 3% of the amount of each cash advance, whichever is greater

- Late Payment Penalty Fee: Up to $40

- You’re a current Sam’s Club or Sam’s Club Plus member

- You frequently purchase gasoline with a credit card

- You do’t want to pay an annual fee or foreign transaction fee

- You spend heavily on dining each month

If you buy in bulk, the Sam’s Club credit card is a great way to save big bucks on grocery runs. The box store is ideal for prepping for holidays, summer cookouts, graduation parties, work events, and more.

Other Things to Consider with Walmart

Like other grocery delivery services, there are several potential limitations when using Walmart or Walmart+ to deliver your food. Here are some drawbacks you may run into:

- Delivery fees: Many grocery delivery services charge additional fees for delivery, which can increase the overall cost of your groceries. While some offer free delivery for orders above a certain amount, smaller orders may incur delivery charges.

- Limited delivery areas: Grocery delivery services may not be available in all areas or regions. You might not have access to this service if you live in a rural or remote location. Additionally, certain grocery items might be out of stock or unavailable for delivery. The delivery time slots might also be limited, making it challenging to get groceries delivered exactly when needed.

- Quality control: There’s a chance that the quality of perishable items (such as fruits and vegetables) may not meet your expectations. Some customers have reported receiving items that were not as fresh as they would have liked. When an item you’ve ordered is out of stock, the delivery service may substitute similar products. While they usually aim to find suitable replacements, it may not always match your preferences.

It’s important to note that not all customers will experience these drawbacks, and many find grocery delivery services to be highly convenient and useful. However, it’s essential to be aware of these potential issues when considering using Walmart+ or any other grocery delivery service.

How to Save Even More with Walmart Groceries

Are you looking to maximize your savings when buying groceries through Walmart or Sam’s Club? Here are a few secret hacks to save even more:

- Free Trial: Tons of food delivery services offer free trials to new users – and Walmart+ is no different. Walmart offers new accounts a free 30-day trial for their Walmart+ subscription that you can cancel anytime, meaning you can try the delivery service out (and all of Walmart’s other features) for free.

- First order bonus: New Walmart grocery delivery customers can use a one-time promo code to save even more on groceries. Simply use the promo code WOWFRESH during checkout and save $10 on your first order of at least $50.

- Walmart InHome: Walmart InHome is an upgrade to the basic Walmart+ subscription. This elevated tier, at a $19.95 monthly charge, allows Walmart couriers to put your groceries in the fridge for you. This service also applies to Walmart returns, meaning you won’t have to worry about mobility issues hampering your shopping.

Amazon Fresh

Amazon Fresh is an online and physical grocery store. The service was launched in 2007 and now covers over 2,000 locations across the United States.

Where Can You Use Amazon Fresh Grocery Delivery?

One of the biggest drawbacks of the Amazon Fresh delivery service is that it is not universal across the United States. Currently, Amazon Fresh is available in over 2,000 cities across 24 states, however. Here is a list of states where Amazon operates its Amazon Fresh delivery service:

| Where is Amazon Fresh available? | |||

|---|---|---|---|

| Arizona | Illinois | Nevada | Oregon |

| California | Indiana | New Hampshire | Pennsylvania |

| Connecticut | Kentucky | New Jersey | Tennessee |

| Delaware | Maryland | New York | Texas |

| Florida | Massachusetts | North Carolina | Virginia |

| Georgia | Michigan | Ohio | Washington |

Physical Store Locations

Amazon also offers standalone, physical Amazon Fresh locations in 8 states and the District of Columbia (DC). These locations include over 15 locations in California, 10+ in Illinois, 5 locations in Virginia, and more. All Amazon Fresh stores are open 8 AM – 10 PM daily.

Amazon Fresh offers far more than just same-day grocery delivery or free grocery pickup with your Amazon Prime membership. Prime customers enjoy free in-store pickup and returns of Amazon packages, they can save time with Order Ahead and Alexa Shopping List in the Amazon app, and can skip checkout with the Amazon Dash Cart and Just Walk Out shopping.

Other Things to Consider with Amazon Fresh

While Amazon Fresh offers convenience and a wide selection of groceries delivered right to your doorstep, there are caveats to using the service. Here are a few considerations to consider before using Amazon Fresh:

- Delivery Fees: Amazon Fresh typically charges a delivery fee for orders below a certain minimum purchase amount. This fee can add up, especially if you use the service frequently or mainly for smaller purchases. Always make sure the delivery fees justify the costs of placing an order and waiting (if possible) to order.

- Subscription Requirement: In some areas, Amazon Fresh may require a subscription to Amazon Prime or Amazon Fresh itself to access the grocery delivery service. This additional cost might not be ideal if you are an occasional shopper or if you prefer to shop in physical stores.

- Product Selection: While Amazon Fresh offers a wide variety of groceries, it might not have every item available at your local grocery store, particularly for local or specialty items. There is no ability to check produce or meats, for example.

- Packaging Waste: Grocery delivery services like Amazon Fresh often use additional packaging materials to protect products during transportation. This can result in increased waste compared to shopping in physical stores, where you can use reusable bags.

- Substitutions and Freshness: Like any online grocery service, Amazon Fresh may face challenges in fulfilling specific items in your order. If an item is out of stock, they might substitute it with a similar product, which might not always suit your liking. Additionally, concerns about the freshness of perishable items may arise, as you don’t have the opportunity to choose them yourself.

- Delivery Time Slots: Popular delivery time slots can get booked quickly, especially during peak hours or busy days. Securing a convenient delivery time might require planning ahead or being flexible with your schedule.

- Delivery Issues: Despite Amazon’s efforts to provide a reliable service, there can be occasional delivery hiccups, such as delays or missing items. Dealing with these issues can be time-consuming and frustrating – especially if your ice cream melts in the summer heat!

- Dependency on Technology: Using Amazon Fresh relies heavily on technology and internet connections. If you experience technical difficulties or lack internet access, this can disrupt your grocery shopping plans.

- Lack of Personal Touch: Online grocery shopping eliminates the personal interaction and experience of shopping in a physical store. Some people enjoy the social aspect of grocery shopping or appreciate the assistance of store staff. Fortunately, Amazon offers in-person shopping, but these locations are not as widespread.

Amazon Fresh Credit Cards

There are multiple co-branded credit cards for Amazon shopping. These cards include consumer and small business credit cards issued by Synchrony, Chase, and American Express. Here’s an overview of the two Chase credit cards:

| Prime Visa | Amazon Visa | |

|---|---|---|

| Amazon Prime membership required? | Yes | No |

| Rewards | Earn 5% back on Amazon.com and Whole Foods Market purchases | Earn 3% back on Amazon.com and Whole Foods Market purchases |

| Earn 5% back on purchases made through Chase Travel | Earn 3% back on purchases made through Chase Travel | |

| Earn 3% back on purchases at restaurants, gas stations, and drug stores | Earn 2% back on purchases at restaurants, gas stations, and drug stores | |

| Earn 2% back on local transit and commuting, including rideshares | Earn 2% back on local transit and commuting, including rideshares | |

| Earn 1% back on all other purchases | Earn 1% back on all other purchases | |

| Annual fee | No annual fee | No annual fee |

And here are Amazon’s other credit cards from Amex and Synchrony:

How to Save Even More with Amazon Fresh

Amazon has dozens of services, which means tons of ways to save even more when shopping for groceries. Here are a few of our favorite ways to maximize your savings while using Amazon Fresh:

Subscribe & Save

One of the easiest ways to save even more with Amazon Fresh is by using Amazon’s Subscribe & Save feature. It’s a handy subscription service that saves up to 15% on your repeat delivery orders at Amazon. For example, using Subscribe & Save can save you time, money, and peace of mind if you frequently purchase toilet paper or baby formula.

With Subscribe & Save, you can shop from thousands of eligible household items like tissues, laundry detergent, pet food, cleaning products, and more. The service is incredibly flexible, and you can cancel it anytime.

Amazon Outlet

Amazon has many overlooked services that can save you significant money. One of the best services for savings is the Amazon Outlet. The outlet is Amazon’s overstocked section, where returns, overstocked items, and other clearance discounts are available.

Amazon Outlet also offers exclusive deals unavailable on the main Amazon platform, including discontinued and open-box items across many categories, including computers and electronics, paper goods, office supplies, clothing, beauty and health, pet supplies, books, and more. You can even find grocery items in the Outlet, including things like canned goods, condiments, coffee, pet food, and more.

Prime Day

Amazon Prime Day is a multi-day event exclusively for Amazon Prime members. During the event, Amazon offers doorbuster deals on everything from televisions and appliances to home furnishings, clothing, and even grocery items.

Prime Day was created to celebrate Prime members, with the first event launched in 2015. Now, the company is applying greater savings across all departments, including grocery items. Just some examples of recent grocery deals during Prime Day include:

- 20% off in-store purchases at Whole Foods locations.

- 30% on early Prime Day deals Amazon Fresh

- $20 off purchases of $100 or more online during the event

- 6% cash back to members who use their eligible Amazon credit card at Amazon Fresh stores.

Pay attention to the items you are ordering regularly. When Prime Day arrives, check for special savings on those products, and if so, buy in bulk.

Related Article: The Best Credit Cards for Amazon Prime Day

Instacart

Instacart provides access to many local, regional, and national brands. In Florida, for example, you can expect the normal names you’d see everywhere, including Publix, Aldi, Petco, Total Wine, and more.

Where Can You Use Instacart?

Instacart is available in all U.S. states, as well as the District of Columbia, Puerto Rico, and many other territories.

What are the Benefits of Instacart?

Using a service like Instacart for your groceries has several benefits. For starters, there’s the convenience the service provides.

Instacart allows you to shop for groceries from the comfort of your home or on-the-go through their mobile app. This eliminates the need for travel, parking, and waiting in long checkout lines. Additionally, by outsourcing the shopping to Instacart shoppers, you save time that can be better spent on other activities, like work, hobbies, or exercise – or spending quality time with family and friends.

Another benefit of Instacart is the huge number of options available. Unlike Amazon Fresh, which relies on Amazon warehouses to operate, Instacart is a third-party service that works with local supermarkets. This local cooperation means you can access the same groceries and goods as other local shoppers.

In addition, using Instacart for grocery deliveries gets you real-time updates on your shopping (and delivery). As your shopper picks and packs your items, you can track the progress and get real-time updates on your order status, including substitutions and produce options.

Finally, Instacart offers various delivery options, including same-day delivery in many areas. You can choose a convenient delivery window that fits your schedule. The service even provides contactless delivery options, ensuring safety during times of health concerns or when you prefer minimal interaction.

Drawbacks and Limitations of Instacart

Like Amazon Fresh, Walmart+ and others, Instacart has its disadvantages and limitations. Here are some of the key ones to consider:

- Service Fees and Tipping: Instacart charges service fees on each order, and customers are encouraged to tip their shoppers separately. These additional costs can add up, making the service more expensive than traditional grocery shopping. Pay close attention to things like surge pricing during peak times, resulting in higher delivery fees. This can catch customers off guard and lead to increased expenses.

- Product Quality and Substitutions: Instacart offers better product selection vs. Amazon Fresh or Walmart+. Still, shoppers may need to make substitutions for out-of-stock items, which might not always align with the customer’s preferences. The shopper’s choice may not be the exact brand or product the customer wanted, leading to potential disappointment.

- Delivery: Instacart may not be available in all parts of your state, particularly in rural or less populated regions. Popular delivery time slots can also fill up quickly, especially during peak hours or busy days. This could result in customers scheduling deliveries further in advance or at less convenient times.

- Inconsistent Delivery Experience: Instacart relies on a network of independent shoppers so the delivery experience can vary significantly. Some shoppers may be attentive and communicative, while others may not meet customer expectations. While Instacart strives for accuracy, mistakes can happen.

- Packaging Waste: Grocery delivery services like Instacart often use additional packaging materials to protect products during transportation. This can result in increased waste compared to shopping in physical stores, where you can use reusable bags.

Instacart Credit Card

Perhaps the easiest way to maximize savings with Instacart grocery deliveries is by getting the Instacart Mastercard®. The no annual fee credit card from Chase earns 5% back on Instacart purchases, offers a one-year free Instacart+ membership, and more.

Instacart Mastercard®

Instacart Mastercard®

Instacart Mastercard®

- 20.24% to 28.99% Variable Regular Purchase APR

- 20.24% to 28.99% Variable Balance Transfer APR

- 29.99% Variable Cash Advance APR

At a Glance

The Instacart Mastercard® is a cash back card that offers big savings on food and grocery deliveries. The no annual fee credit card from Chase earns 5% back on Instacart purchases, offers one-year free ofInstacart+ membership, and more.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Get a free year of Instacart+ and a $100 Instacart credit automatically upon approval. Membership auto-renews. Terms apply.

- Earn 5% cash back on Instacart app and Instacart.com purchases

- Earn 5% cash back on travel purchased through the Chase Travel Center, including flights, hotels and more

- Earn 2% cash back at restaurants, gas stations and on select streaming services

- Earn 1% cash back on all other purchases

- No annual card fee

- Regular Purchase APR: 20.24% to 28.99% Variable

- Balance Transfer APR: 20.24% to 28.99% Variable

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% Variable

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Penalty APR: Up to 29.99% Variable

- You get your groceries or food delivered through Instacart

- You have wanted to try out Instacart+

- You want a $100 Instacart credit to start chowing down today

- You do’t want to pay an annual fee

Instacart Mastercard®

Terms & ConditionsChase Bank issues the Instacart Mastercard. The bank also provides Instacart benefits on several of its other credit card products. These benefits can include statement credits and other special savings. Other discounts for Instacart may be available from your credit card’s payment network, including Visa or Mastercard (which is the network through which the Instacart Mastercard is available).

How to Save Even More with Instacart

Instacart provides additional ways to save money on deliveries. For example, if you prefer to avoid delivery fees altogether, Instacart Pickup allows you to order groceries online and collect them from the store at a designated time.

Here are a few other great ways to save even more money when using Instacart for your groceries:

Instacart+

The easiest way to save extra money with Instacart is by joining Instacart+, the app’s membership service. This premium service is currently $9.99 per month or $99 when billed annually and offers free delivery on eligible orders over $35+, special discounts, and buy one, get one (BOGO) offers.

Add Your Loyalty Programs

If you are a loyal customer of a particular grocery chain, you can save even more with Instacart. If your chosen grocery store has a loyalty program, provide your account information to the Instacart shopper to take advantage of store-specific discounts and rewards.

Compare Prices Before Buying

Instacart works with hundreds of different brands across many different industries. While shopping on Instacart, you can easily compare prices between different grocery stores to find the best deals on the items you need. Simply create multiple carts and compare the overall costs to see which market provides the best value for you.

DoorDash

DoorDash is another delivery service that has branched out into grocery deliveries. Like Instacart, DoorDash offers delivery of items from convenience, pet, health & beauty, electronic, liquor, and grocery stores in your neighborhood. The DashPass membership offers a $0 delivery fee on orders over $12, special member’s-only discounts, and more. Subscriptions cost $9.99 per month, or $99 when billed annually.

Where Can You Use DoorDash?

DoorDash is available in all U.S. states, as well as the District of Columbia, Puerto Rico, and many other territories.

DoorDash Credit Cards

Along with Instacart, Chase issues a co-branded credit card with DoorDash, the DoorDash Rewards Mastercard®.

DoorDash Rewards Mastercard®

DoorDash Rewards Mastercard®

DoorDash Rewards Mastercard®

- 20.24% to 28.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 20.24% to 28.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The DoorDash Rewards Mastercard® makes ordering out a breeze thanks to up to 4% cash back on DoorDash purchases, 2% back on groceries, a free year of DashPass (a $96 value), and a selection of Mastercard perks and protections.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- With the DoorDash Rewards Mastercard get a FREE year of DashPass ($96 value).

- 4% cash back on DoorDash and Caviar orders. Enjoy this benefit on every type of DoorDash order, including restaurants, groceries, pet supplies, retail items, and more. No earning caps.

- 3% cash back on dining when purchased directly from a restaurant. No earning caps.

- 2% cash back on purchases from grocery stores, online or in person. 1% cash back on all other purchases. No earning caps.

- Get a complimentary DashPass membership ($96 value) every year with $10k in annual card spend. DashPass members enjoy $0 delivery fees & reduced service fees on every eligible order.

- No annual card fee, just cash back on every purchase.

- As an exclusive Cardmember benefit, get 10% off one Convenience, Grocery, Alcohol, Retail or DashMart order every month. Maximum discount of $15 per order. Offer expires 12/31/2024.

- Member FDIC

- Regular Purchase APR: 20.24% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 20.24% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Penalty APR: Up to 29.99% variable based on the Prime Rate

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You love to order in and want to save money

- You can make use of the many services DoorDash offers, including groceries

- You want a $100 cash bonus after spending $500 on purchases in the first three months

DoorDash Rewards Mastercard®

Terms & ConditionsAgain, like Instacart, many Chase credit cards also enjoy DoorDash benefits like statement credits and free DashPass membership. Many premium travel cards also provide DoorDash benefits, including the Gold Card from American Express and Chase’s Sapphire Reserve and Sapphire Preferred credit cards. Always check the benefits information in your credit card welcome pack to fully understand your benefits.

How to Save Even More with DoorDash

Here are a few handy tips for maximizing your savings with DoorDash:

| ① Order during off-peak hours | Many restaurants on DoorDash offer discounts and incentives during off-peak hours to attract customers. Avoiding peak ordering hours can save you money – and you might get your food more quickly, too. |

| ② Wait to place larger orders | DoorDash is a great tool for anyone who wants food, groceries, or other goods delivered to them, same day. With DashPass, you’ll get free delivery on orders over $12, so waiting to order groceries can save you money. Additionally, many restaurants offer discounts on larger orders, so you can save even more money. |

| ③ Check for exclusive deals | DashPass offers access to exclusive discounts and promotions. Before ordering, check the “DashPass Deals” section of the app to see if any of your favorite restaurants are offering any discounts. |

| ④ Refer friends | DoorDash offers an incentive for referring friends or family to the service. You can earn $10 in credits for every friend you refer – a great way to score a free meal, just for showing DoorDash some love. |

| ⑤ Use a rewards credit card | When ordering your DoorDash meal, make sure to pay using a rewards credit card. Consider a dining rewards card, including the DoorDash Mastercard. |

Costco

Costco is a multinational box store and wholesaler based in Washington state. With hundreds of locations worldwide, Costco provides a wide selection of merchandise, plus the convenience of specialty departments and exclusive member services – all designed to make your shopping experience pleasurable. These services also include delivery and grocery services.

Where is Costco Available?

Costco, like Kroger, is a national brand that lacks a uniform presence across the United States. Only Maine lacks a single Costco location, but most locations are centered in the southwest, specifically Texas, California, Arizona, Washington, and Colorado.

There are other restrictions to consider as well, such as not all areas qualifying for CostcoGrocery, the brand’s on-demand grocery service. In those locations, same-day delivery is available through Instacart, while Costco offers free 2-day shipping on non-perishable goods like coffee, bath tissue, laundry detergent, snacks, and more. However, these 2-day orders require a minimum purchase amount of $75 to qualify for free shipping.

Why Get Your Groceries at Costco?

Getting your groceries at Costco can offer several benefits, which have made it a popular shopping choice for many people:

- Cost savings: Costco is renowned for offering bulk quantities of products of every variety at discounted prices. Purchasing in bulk can mean significant cost savings over time, especially for non-perishable items and household essentials you frequently go through – or if you often shop for a large family or group of people.

- Range and quality of products: Costco carries a wide selection of products, ranging from groceries and fresh produce to electronics, clothing, and household items. This variety lets you consolidate your shopping needs and find everything in one place.

- Membership perks: While Costco requires a membership to shop, the benefits can outweigh the cost for many shoppers. Membership perks may include access to special discounts, exclusive services, and cash back rewards on purchases. Many Costco locations also have gas stations offering discounted gas prices to members, leading to additional savings.

- Free samples: Arguably the best part of Costco is the free samples on offer inside every Costco location. Additionally, Costco often has a variety of prepared foods, making it convenient for quick meals and entertaining guests.

Despite these benefits, it’s critical to consider your house’s storage capacity and individual shopping preferences before shopping for groceries at Costco. While buying in bulk can save money, it may not be suitable for everyone, especially for smaller households.

Costco Credit Cards

Costco offers two co-branded credit cards, one business and one personal, issued by Citi:

The Costco Anywhere Visa® Cards by Citi provide lucrative cash back rewards on purchases like gas, travel, and dining, with the best rewards coming from Costco purchases and travel bookings. The cards both feature no annual fee with your paid Costco membership – and the card even acts as your Costco membership card.

Beyond no annual fee, cardholders also enjoy no foreign transaction fees on purchases and receive an annual credit card reward certificate, which is redeemable for cash or merchandise at Costco warehouses in the U.S. as well as in Puerto Rico.

Related Article: Best Credit Cards To Use at Costco

Other Delivery Services for Groceries

Other delivery apps also provide grocery deliveries, though their popularity is much lower than Amazon Fresh, Walmart+, or Instacart.

Uber Eats

Uber Eats is something you typically associate with dining delivery and not groceries, but the service provides access to dozens of local and national stores. These services now include groceries, with similar costs, benefits, and issues found with other delivery services.

Barclays used to offer the Uber Visa Signature Card, but that card has been closed to new applicants for some time now. Despite this, one of the great things about Uber Eats is that so many credit cards offer special discounts with Uber. Cards like the Amex Gold and Platinum Cards, the Chase Sapphire Reserve, and several other cards offer Uber statement credits that can apply towards Uber Eats dining and grocery deliveries. Always check the benefits information in your credit card welcome pack to fully understand your benefits.

Other Services

Other services, which are more of a cross between a meal delivery service and a grocery delivery service, include:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.