by Cory Santos | Last updated on February 1st, 2024

American Express® Gold Card

American Express® Gold Card

American Express® Gold Card

- See Pay Over Time APR Regular Purchase APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

Foodies, rejoice! The American Express® Gold Card grants you the ability to earn 4X Membership Rewards® points at restaurants worldwide and US supermarkets, and 3X Membership Rewards® points on flights booked directly with airlines or via amextravel.com. There are also numerous travel perks of note, including statement credits for hotel and airline purchases.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 75,000 Membership Rewards® points after you spend $4,000 on eligible purchases with your new Card within the first 6 months of Card Membership

- Earn 4X Membership Rewards® points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X)

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required

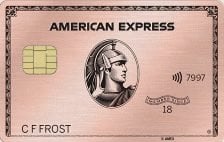

- Choose the color that suits your style. Gold or Rose Gold

- No Foreign Transaction Fees

- Annual Fee is $250

- Terms Apply

- Regular Purchase APR: See Pay Over Time APR

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater

- Penalty APR: 29.99% variable based on the Prime Rate

- Annual Fee: $250

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You want to earn 4X Membership Rewards® points for global restaurant purchases, including takeout and delivery

- You also wish to earn 4X Membership Rewards® points on purchases at U.S. supermarkets (up to $25,000 annually)

- You travel often and can take advantage of 3X Membership Rewards® points on flights booked directly with airlines or via amextravel.com

- You would benefit from statement credits on a variety of travel expenses

In-Depth Review: American Express® Gold Card

The American Express® Gold Card caters to epicureans’ lifestyles that appreciate dining at trendy restaurants and the in-home chef who loves hosting meals for friends and family. Besides being a fantastic card for foodies, it offers competitive travel rewards and statement credits for airline and hotel stays. The American Express Gold Card charges an annual fee of $250.

Eligibility

You typically need a good to excellent credit score to qualify for the American Express Pay in Full cards, including the American Express Gold Card. One of the unique aspects of cards like this, however, is that sometimes people with scores on the lower end of “good” can qualify, thanks to the Pay in Full nature of the card.

Choose Your Card Design

New applicants can select their preferred Amex Gold Card when applying. Available options include the stylish Rose Gold Card or the classic Gold Card.

|

|

Pay Over Time

While the Gold Card is a charge card, that does not mean cardholders can’t enjoy the chance to carry a balance. American Express offers a special “Plan It” feature that allows charge cardholders to finance select purchases at a competitive APR.

Cardholders can activate Pay Over Time and select charges, which will automatically be added to the feature. Gold Cardholders can pay the balance in full or carry that balance with interest. The Plan It credit limit is found in the balance details on a user’s account (see terms).

How to Earn Rewards with the Amex Gold

A Huge Welcome Offer

After meeting minimum spending requirements, the Gold Card from American Express often features welcome offers of between 60,000 and 75,000 Membership Rewards points. Unfortunately, like the Platinum Card, American Express now uses a “dynamic” welcome offer format, meaning you’ll never know your offer until you apply and are approved. Still, new accounts can anticipate a welcome offer within that range.

How to Earn Rewards

Amex Gold cardholders can earn 4X Membership Rewards® points per dollar spent on purchases at restaurants around the world, 4X Membership Rewards points when shopping at U.S. supermarkets (up to $25,000 in purchases each year), and 3X Membership Rewards® points for flights booked directly via their respective airlines or at amextravel.com.

Unfortunately, the Dining category does not include bars, nightclubs, cafeterias, convenience stores, or restaurants inside hotels. The travel rewards category also has restrictions, and rewards points are only for airfare. Still, cardholders could easily supplement this with a more general travel card or a hotel rewards card.

How to Redeem Amex Membership Rewards

Like other loyalty programs, Amex Membership Rewards points apply to various redemption options. Those redemption options include:

| Travel | Hotels | Airfare |

| Cruises | Merchandise with select partners | Gift cards |

| Statement credits | Charitable donations | Transfer to partners |

Membership Rewards have an average value of $0.01, but Amex points usually have a higher average value when transferred to partners. American Express Membership Rewards are of exceptional value because they transfer to many other airlines and hotels. These include:

Gold Card Statement Credits

Dining Statement Credits

The Gold Card also comes with dining statement credits worth up to $120 per year. When using the Amex Gold Card to pay for dining purchases at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar, and select Shake Shack locations, cardholders earn up to $10 monthly statement credits.

Uber Statement Credits

The Gold Card also includes an additional monthly statement credit towards Uber or Uber Eats. Cardholders who register their Gold Card as a payment option through their Uber or Uber Eats account automatically receive a $10 monthly credit. This new bonus amounts to $120 per year.

Other Card Benefits

Like other American Express products, the Gold Card features a variety of benefits and protections. These features include:

- Baggage Insurance Plan for up to $1,250 for carry-on baggage and up to $500 for checked baggage

- Amex Global Assist® Hotline and access to Personalized Travel Service

- Access to the American Express Hotel Collection

- No foreign transaction fees

Cardmembers enjoy American Express network benefits and safety protections including:

| Extended Warranty | Return Protection | Car Rental Loss & Damage Insurance | Amex Concierge |

| Purchase Protection | Zero Fraud Liability | Trip Delay Insurance | Amex Offers |

Comparison

| Dining rewards (X/% per $1 Spent) | Other Reward Categories | Other Features | |

|---|---|---|---|

| DoorDash Rewards Mastercard® | 4% back with DoorDash & Caviar; 3% back on when purchased directly from a restaurant | 2% back on groceries and 1% back on all other purchases | Complimentary DashPass for first year; no annual fee; no foreign transaction fees |

| Capital One® Savor® Cash Rewards | 4% back on dining | 4% back on entertainment and popular streaming services; 3% back on groceries; 1% back on all other purchases | Postmates Unlimited membership statement credit; $95 annual fee |

| Citi Custom Cash℠ Card | 5% on purchases on your highest eligible spend category each billing cycle, up to $500 spent | 1% back on all other purchases | 0% intro APR for 15 months from account opening on purchases and balance transfers; no annual fee |

| American Express® Gold Card | 4X Membership Rewards® points at Restaurants, plus takeout and delivery in the U.S., 4% back on at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X) | 3X on flights booked directly with airlines or on amextravel.com | $120 Uber Cash on Gold; $100 dining credit; $250 annual fee |

Amex Comparison

| The Platinum Card® from American Express® | American Express® Gold Card | American Express® Green Card | |

|---|---|---|---|

| Annual fee | $695 | $250 | $150 |

| Earn 5X Membership Rewards® points on flights booked directly with Amex and prepaid hotels booked at amextravel.com, and 1X on all other purchases | Earn 4X Membership Rewards® points at Restaurants, including takeout and delivery in the U.S., plus at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X), 3X on flights booked directly with airlines or through Amex, and 1X on all other purchases | Earn 3X Membership Rewards® points on global restaurants, including takeout and delivery, plus 3X on all eligible travel, and 1X on all other purchases | |

| Statement credits | Up to $1500 | Up to $240 | $100 |

| Lounge access | Priority Pass Select | N/A | $100 Loungebuddy credit |

What We Like About the Gold Card

Perhaps the best feature of the Gold Card is its generous rewards program. Cardholders earn accelerated rewards in key everyday categories, like dining, groceries, and travel. These rewards are on par with cards like the Capital One Savor. However, the Gold Card provides superior statement credits to the Savor Card, edging that offer out for those applicants who really plan to maximize those bonus categories.

Things to Consider

Despite the great features, there are still downsides to the Gold Card. The annual fee might put some people off – especially considering the card’s rewards are fairly narrow. While the card’s benefits may outweigh the fee for some individuals, assessing whether you will utilize the rewards and perks enough to justify the cost is crucial.

American Express Ratings

How does American Express rate as a bank and issuer? Here is a selection of ratings for the bank from consumers and experts:

| BestCards | Better Business Bureau | TrustPilot |

|

3.5/5 |

2/5 |

1.5/5 |

Should You Apply for the American Express® Gold Card?

Overall, the Amex Gold Card is a competitive reward for those who want dining, supermarket, or travel rewards. Although the annual fee is relatively high (and not waived during the first year), recovering the cost is very doable for the average individual and their family.

It is suitable for use as your primary card, but the reward categories also allow room for use with other types of rewards cards, particularly gas and hotel cards. For those who cannot swing the $195 annual fee, some comparable alternatives would be the Capital One Savor ($95 annual fee that is waived the first year) or the Discover it® Cash Back (no annual fee). The Chase Sapphire Preferred is another option with a great, low annual fee.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.