Filter Options

×-

-

Unselect all

-

Unselect all

-

Unselect all

Showing 66 Cards

Sort By Column Name:

Taz Visa®

Taz Visa®

- 29.99% variable based on the Prime Rate Regular Purchase APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The Taz Visa® is a credit builder credit card that offers a platform for responsible use but little else. The card, from First National Bank, continuously monitors for credit limit increases, giving you the tools you need to demonstrate a positive credit history and graduate to more impressive rewards cards in the future.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Stay on top of your account with the Taz mobile app

- U.S. based customer service

- 24/7 zero liability fraud protection

- Taz regularly monitors for credit limit increases

- Regular Purchase APR: 29.99% variable based on the Prime Rate

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: 2% of the amount of each cash advance

- Annual Fee: See Terms

- Late Payment Penalty Fee: Up to $7.50

- Return Payment Penalty Fee: Up to $25

- You have bad credit and want to repair it with responsible use

- You can afford the steep annual fee

- You don’t plan on using the card to carry a balance

- You have a mail offer from Taz

OneMain Financial BrightWay℠

OneMain Financial BrightWay℠

- 29.74% or 30.49% variable based on the Prime Rate Regular Purchase APR

- 29.74% or 30.49% variable based on the Prime Rate Balance Transfer APR

- 29.74% or 30.49% variable based on the Prime Rate Cash Advance APR

At a Glance

The OneMain Financial BrightWay℠ credit card can help you build credit, lower your APR, and graduate to no annual fee - all from one card. The Mastercard from WebBank offers the chance of a credit limit increase or lower APR in as little as six months, but requires an invite to apply.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Build your credit with no-time payments and graduate to the $0 annual fee Brightway+ credit card

- Lower APR or higher credit limit with 6 on-time payments

- 24/7 zero liability fraud protection

- Stay on top of your account with the Brightway mobile app

- Regular Purchase APR: 29.74% or 30.49% variable based on the Prime Rate

- Balance Transfer APR: 29.74% or 30.49% variable based on the Prime Rate

- Balance Transfer Transaction Fee: Once available, either $10 or 3% of the amount of each balance transfer, whichever is greater

- Cash Advance APR: 29.74% or 30.49% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 3% of the amount of each cash advance, whichever is greater

- Annual Fee: See Terms

- Foreign Transaction Fee: 1% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $40

- You have average credit and want to repair it with responsible use

- You don't want a confusing reward scheme

- You don’t plan on using the card to carry a balance

- You recieved a reservation code from OneMain

Current Build Card

Current Build Card

- 0.00% Regular Purchase APR

- 0.00% Cash Advance APR

At a Glance

The Current Build Card is a no annual fee secured card that builds credit while earning up to 7X points and 4% APY on savings. The card features no account minimums, no overdraft fee, and spending insights to help your build credit.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Build credit with no minimum deposits and no annual fee

- Up to 4% APY on savings

- Earn up to 7X points on purchases with over 14,000 merchants

- No overdraft fee

- Regular Purchase APR: 0.00%

- Cash Advance APR: 0.00%

- Annual Fee: $0.00

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: 3% of any Total Due balances outstanding and past due for two or more billing cycles

- You are new to credit and want an easy way to begin building credit

- You plan on utilizing Current's spending insights to help you save money

- You don't want to pay an annual fee to earn rewards

Self Visa® Credit Card

Self Visa® Credit Card

- 29.24% (Variable) Regular Purchase APR

At a Glance

The Self Visa® Credit Card is a secured credit card that pairs with an existing Self Credit Builder Account. The card has no formal approval process. Instead, hopeful consumers simply need to open a Self account and save over $100 to fund the secured Visa account.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

-

Apply Now: Intro No Annual Fee with the secured Self Visa® Credit Card^ • If you have an active Credit Builder Account, $100 or more in savings progress and satisfying income requirements you may be eligible to receive the secured Self Visa® Credit Card*, without a hard credit check. Criteria subject to change. • Build credit and savings at the same time. • Start with a Credit Builder Account* that reports monthly payments to all 3 major credit bureaus. • At the end of your plan, unlock the savings you built - minus interest and fees. • The secured Self Visa® Credit Card is accepted at millions of locations in the U.S. *Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval. The secured Self Visa® Credit Card is issued by Lead Bank or First Century Bank, N.A., each Member FDIC. See Self.inc for details. Subject to ID Verification. Individual borrowers must be a U.S. citizen or permanent resident and at least 18 years old. Valid bank account and Social Security Number are required. All loans are subject to consumer report review and approval. The Secured Self Visa® Credit Card requires an active Self Credit Builder Account and qualification based on other eligibility criteria including income & expense requirements. Criteria subject to change.

^$0 annual fee for the first year only, $25 annual fee thereafter. Variable APR of 28.24%. Offer valid for new customers only.

- Regular Purchase APR: 29.24% (Variable)

- Annual Fee: $25

- Late Payment Penalty Fee: Up to $15

- Return Payment Penalty Fee: Up to $15

- You're serious about raising your credit score

- You already have a Self Credit Builder Account

- You don’t mind the card's $25 annual fee

- You plan to pay your card balance in full every month

Zolve Credit Card

Zolve Credit Card

- 16% variable based on the Prime Rate Regular Purchase APR

At a Glance

The Zolve Credit Card is a credit builder credit card that helps new arrivals to the U.S. build credit and move on to more impressive rewards from the same program. The Zolve credit card earns unlimited 1% cash back and offers additional benefits with no annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Up to $5,000 credit limit

- Earn 1% unlimited cash back

- Earn up to 10% cash-back at over 10,000 shopping outlets

- Regular Purchase APR: 16% variable based on the Prime Rate

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You are a new arrival to the United States and want to begin building credit

- You prefer a card program that grows with you - not one you grow out of

- You are happy with basic rewards and plan to stick with the free option

You've viewed 5 of 66 credit cards

What Is a Poor Credit Score?

A bad credit score is a score that falls below what credit reporting bureaus deem to be average, or “fair.” Bad scores indicate that a person is at a higher risk of missing payments, making late payments, or defaulting on their loans.

To put it bluntly, a bad or poor credit score tells a bank or lender that an individual is less creditworthy than someone with a higher score. Fortunately, credit scores are not set in stone. Instead, they are easily changeable through proactive measures and following financial best practices.

Credit Score Range

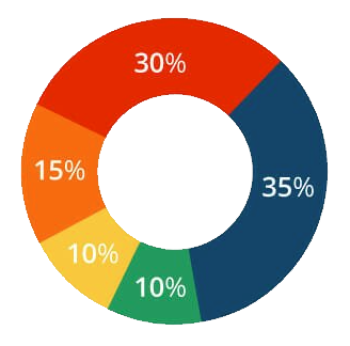

Before fixing a damaged credit score, it is crucial to understand what a credit score is, and what is considered good, bad, or ugly by different credit reporting bureaus. The two main credit scoring models that banks use to gauge creditworthiness are FICO and VantageScore.

FICO is the oldest of the credit scoring systems, and as such, is the most popular among banks. A FICO score ranges from 300 to 850, with ratings ranging from Very Poor (bad) to Exceptional VantageScore is a newer scoring model created by the three leading credit agencies: Experian, Equifax, and TransUnion. Like FICO, VantageScore ranges from 300 to 850, but places more scoring weight on newer credit histories than FICO.

| FICO Scoring Factor | % of Score |

| Payment history/ late payments | 35% |

| Total amount owed on credit accounts | 30% |

| Average length of credit history | 15% |

| Types of credit accounts | 10% |

| New credit applications (hard inquiries) | 10% |

How Poor Credit Can Hurt You Financially

What impact can a bad credit score have on your financial life? Or even your everyday life, for that matter? Understanding how a bad credit score can impact your life negatively is essential in building a better financial future. Understanding how a bad credit score can impact your life negatively is essential in building a better financial future.

Here are the biggest impacts of bad credit on your life:

| Tougher odds of receiving new credit offers | Higher loan terms |

| Difficulty finding apartments to rent | Loss of certain job opprotunities |

First and foremost, bad credit can make getting approved for loans, credit cards, and even rental properties challenging. Lenders and landlords typically rely on your credit score to determine your level of risk as a borrower or tenant. With a low credit score, your lender or landlord may deny your applications outright, feeling you are a potential risk.

A bad credit score can also result in higher interest rates for loans and credit cards. This negative impact means you will pay more over time, potentially adding up to thousands of dollars in extra fees and interest charges.

Bad credit can also impact your ability to secure specific jobs or obtain security clearances. Employers and government agencies may check your credit report as part of the hiring or clearance process.

How to Improve a Poor Credit Score

Bad credit has serious ramifications in everyday life. Fortunately, there is something you can do – here are some of our top tips for improving your credit score:

| ① Check your credit score | The first thing you should do is check your credit score to see where you stand. You might already know your credit score is bad, but how far down on the scale, does it go? Knowing how fast you can improve your credit from “bad” to “fair” is crucial to making a financial plan of attack. |

| ② Get a credit card for subprime credit | Part of boosting your credit score is increasing your use of credit. For those with bad credit, this may seem counter-intuitive. Fortunately, there are many unsecured credit cards for poor credit and secured cards that can help you repair your credit score. |

| ③ Pay on time each month | As seen in the scoring models, payment history is the biggest factor in your credit score. Because payment history is so important, paying your credit card bill on time each month is essential to boosting sub-prime credit. Missed payments stay on a credit report for seven years. |

| ④ Keep your credit use low | Credit utilization is as important as paying on time. Credit utilization shows lenders how you use your credit. Those who keep their credit use below 30% can expect their score to improve, while those who use less than 10% can expect a much faster score rise. |

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.