by Cory Santos | Last updated on January 4th, 2024

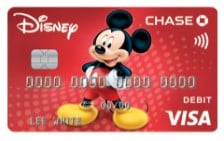

Disney Visa Debit Card

Disney Visa Debit Card

Disney Visa Debit Card

At a Glance

The Chase Disney® Visa® Debit Card is a debit card tied to a Chase checking account. The card offers savings of up to 10% at Disney, plus special photo opportunities and your choice of six custom card designs.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Save 10% on select purchases at Disney store and shopDisney.com

- Pose for special photos at our private Cardmember locations at Walt Disney World® Resort and the Disneyland® Resort

- 10% off select merchandise purchases of $50 or more at select Disney locations

- 10% off select dining locations most days at Walt Disney World® Resort and the Disneyland® Resort.

- 10% off the non-discounted price of select recreation experiences at Walt Disney World® Resort.

- Foreign Transaction Fee: 3% of the transaction in U.S. dollars

- You already bank with Chase

- You love Disney and want special discounts at Disney Resorts and shopping locations

- You don’t want a credit card

- You want to add additional perks to their existing Chase debit card

Disney Visa Debit Card

Terms & ConditionsIn-Depth Review: Disney® Visa® Debit Card

The Chase Disney Debit Card is a co-branded prepaid debit card from Chase and Walt Disney. The card offers exclusive Disney discounts and customizable card designs but requires one of three Chase checking accounts to open.

How to Get the Chase Disney Debit Card

Getting a Disney Debit Card from Chase is pretty straightforward. The card requires one of three Chase checking accounts to qualify: Chase Total Checking, Chase Premier Checking, or Chase College Checking.

Chase Total Checking®

Total Checking is Chase’s most popular checking account product, offering ATM access, online bill pay, mobile banking, and more. The account features a $12 monthly service fee, but this monthly maintenance fee can be waived if the account holder either:

| Makes $500 in electronic deposits each month |

| Maintain a balance of $1,500 or more |

| Keep an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances. |

Chase Premier Plus Checking℠

The Chase Premier Plus account offers the same features as the Total Checking account but earns interest on the money held. This account features a $25 monthly maintenance fee, which Chase waives if:

| The average balance is $15,000 or more |

| Have a linked qualifying Chase first mortgage enrolled in automatic payments linked to the Premier Plus account |

Chase College Checking℠

The College Checking account is the best bet for those who qualify. The account features no monthly service fee for up to five years – as long as the account holder is between 17 and 24 years old when they open it.

Disney Debit Comparisons

| Disney Visa Debit | Extra Debit Card | Point Card | |

|---|---|---|---|

| Annual fee | $0 | See terms | $49 |

| Builds credit? | No | Yes | No |

| Cardholders savings? | Yes, Disney | Yes, 5% APY on savings with Plus | Yes, through partners |

| Rewards | No | 1% back with Plus | Earn 5X points per $1 on subscriptions, 3X points on food deliver and rideshares, and 1X points on everything else |

Disney Perks and Discounts

The man selling point with the Disney Visa Debit Card is the suite of savings cardholders enjoy with Disney and Disney brands. Cardholders enjoy the following Disney savings and special perks:

| 10% savings when using the card while shopping at Disney Stores or online at ShopDisney.com. |

| Save 15% on select Disney guided tours, including Walt’s Main Street Story Tour. |

| 10% off select merchandise purchases of $50 or more at select locations at Walt Disney World® Resort and the Disneyland® Resort. |

| Special photo op access at private Chase Cardmember locations at Walt Disney World® Resort and the Disneyland® Resort. |

| 10% off the non-discounted price of select recreation experiences at Walt Disney World® Resort. |

| 10% off select dining locations most days at Walt Disney World® Resort and the Disneyland® Resort, including the Golden Horseshoe and Goofy’s Kitchen. |

| Exclusive character meets for cardholders in Disney California Adventure Park and Disneyland Park. |

Eligible Guided Tours

| Park | Eligible Tours | |

|---|---|---|

| Disneyland® | Walt’s Main Street Story (Guided Tour) | |

| Celebrating Disney100 at the Disneyland® Resort (Guided Tour) | ||

| Disney’s Happiest Haunts Tour (offered seasonally) | ||

| “Holiday Time at Disneyland®” Tour (offered seasonally) | ||

| Cultivating the Magic (Guided Tour) | ||

| Walt Disney World® | Disney’s Keys to the Kingdom Tour (Magic Kingdom) | |

| EPCOT® Seas Adventures – Dolphins in Depth | ||

| EPCOT® Seas Adventures – DiveQuest | ||

| Behind the Seeds (EPCOT) | ||

| Animal Kingdom® | Caring for Giants | |

| Up Close with Rhinos | ||

| Wild Africa Trek (Mid-Day Tours only; block out dates apply) | ||

| Savor the Savanna: Evening Safari Experience | ||

| Other Tours | Starlight Safari at Disney’s Animal Kingdom Lodge | |

| Wilderness Back Trail Adventure | ||

What We Like About Chase’s Disney Debit Card

The Disney Debit Card from Chase has a lot going for it. The card has no annual fee and can be opened with no additional charges, depending on your Chase checking account. Why that is so nice because it is a debit card, meaning there are no credit checks or credit score considerations to worry about.

Even better, the card provides some impressive perks for the avid Disney fan. The 10% savings on select merchandise, food, and tours with the debit card are exceptional, providing innate value just for being a cardholder.

The wide selection of card designs is another nice feature. Far too many debit cards are bland, so Chase giving customers the ability to select from several designs is wonderful – and is sure to be a hit with anyone from Star Wars fans to Snow White aficionados.

Things to Consider

While the Disney Debit Card offers discounts and savings, it doesn’t provide rewards like cash back or points. If you want reward points, you are stuck with Chase’s two co-branded Disney credit cards: the Disney Visa Card and the premium Disney Premier Visa Card.

Here’s how those cards compare:

| Disney Premier Card | Disney Visa Card | |

|---|---|---|

| Rewards | Earn 2% in Disney Rewards Dollars on card purchases at grocery stores, restaurants, gas stations and most Disney locations | Earn 1% in Disney Rewards Dollars on all your card purchases with no limits to the amount you can earn |

| Welcome offer | $300 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening | $150 Statement Credit after you spend $500 on purchases in the first 3 months from account opening |

| Annual fee | $95 annual fee | No annual fee |

Choose Your Own Card Design

One of the great perks of the Chase Disney Debit Visa is the opportunity to choose your own card design. There are six Disney debit card designs to choose from, including classic options like Mickey Mouse, Mickey and friends, or Cinderella’s Crystal Palace. There are also designs featuring Star Wars and Frozen – meaning there is a card design for Disney fans of all types.

|

|

|

|

|

|

Other Card Features

The card also offers various other features, including Visa debit protections like:

| Dovly Uplift™ credit score monitoring | ID Navigator Powered by NortonLifeLock | Visa Zero Fraud Liability | Lost/Stolen Card Reporting |

These Visa perks are in addition to the benefits you expect from Chase. Chase debit accounts enjoy:

| Online bill pay | EMV chip technology | Contactless payments |

| Digital wallet compatibility with Apple Pay, Google Pay, and Samsung Pay | ||

Other Debit Card Options

Not sure the Disney Debit Card from Chase is right for you? Here are a few other popular debit card options:

| Albert Mastercard® | GO2bank Visa® Debit Card | Yotta Debit Card | |

|---|---|---|---|

| Feature #1 | Earn $150 when you receive a qualifying direct deposit and use your Albert debit card | Overdraft protection up to $200 with opt-in and eligible direct deposit | The only debit card that could literally make someone a millionaire including odds up to 1 in 100 Yotta will cover your entire purchase |

| Feature #2 | Earn cash back rewards when you buy groceries, gas, food and more with your Albert debit card | Free nationwide ATM network Refer a friend, and you both get $50 | Earn 10% of your purchase amount back in the form of tickets into the following week’s sweepstakes |

| Direct Deposit | Get paid up to 2 days early | Get paid up to 2 days early | Get paid up to 2 days early |

Guide to Fees

As mentioned, Chase offers three different types of checking accounts with the Disney Debit Card. Each account features different charges, as outlined below:

| Total Checking | Premier Plus Checking | College Checking | |

|---|---|---|---|

| Monthly Service Fee | $0 or $12 | $0 or $25 | $0 or $6 |

| Overdraft | $34 | $34 | $34 |

| ATM (in network) | $0 | $0 | $0 |

| ATM (out of network) | $3 to $5 | Up to $5 | $3 to $5 |

Disney Visa Debit FAQs

Here are the answers to some of the more commonly asked questions about the Disney® Visa® Debit Card from Chase:

- Chase Total Checking is the bank’s most popular checking and debit service, with a $12 per month charge. That said, most Chase customers enjoy Total Checking at no charge by meeting one of the following requirements:

- Makes $500 in electronic deposits each month

- Maintain a balance of $1,500 or more

- Keep an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances.

- It’s free and easy to change your Chase debit card design anytime. Call 1-877-388-5726 or visit your local Chase branch for more information.

- While Chase uses both the Visa and Mastercard payment networks, most Chase debit and credit card products use Visa.

- Chase offers several Disney discounts through its Disney Debit (as outlined above) and the two Disney co-branded credit cards: the Disney Visa and Disney Premier Visa.

- The checking account associated with the Disney Visa does not require a credit pull, meaning account holders do not qualify for a line of credit. Chase does show some preference to customers when considering credit applications, so applying for and receiving the card might be a hair easier with a good to great credit score and a Chase relationship versus a good credit score and no banking history with Chase.

JPMorgan Chase Banking Ratings

How does the Chase Disney Debit and Total Checking stack up? Here are a selection of expert reviews for the card, as well as an overview of JP Morgan Chase as a bank:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

3.5/5 |

2/5 |

Should You Get the Disney® Visa® Debit Card from Chase?

The Disney® Visa® Debit Card from Chase is an excellent debit card for Chase customers who want savings with Disney but don’t want a credit card (or the credit check that comes from applying for one). The card offers up to 10% savings at the Happiest Place On Earth, plus exclusive photo opportunities the general public can’t access.

There are no rewards with the Disney debit card – something the two co-branded credit cards from Chase provide, but for those who don’t want a hard inquiry on their credit score (or who have no credit history), the card provides additional savings at Disney – with no extra costs beyond the checking account minimum requirements.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.