by Cory Santos | Last updated on January 30th, 2024

Point Card

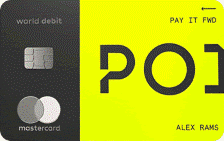

Point Card

Point Card

At a Glance

The Point Debit Card is a fintech debit card that offers credit card rewards and protections but forgoes the credit card or negatives that can come from credit. The card, from Radius Bank, features an annual fee of $49.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 5X points per $1 on subscriptions, 3X points on food deliver and rideshares, and 1X points on everything else

- Membership includes access to exclusive partner offers through collaborations with up-and-coming brands

- Receive up to a $1,000 reimbursement if a new item bought with the Point Card is damaged or lost within 90 days of the purchase

- Get trip cancellation insurance of up to $1,500 for any out-of-pocket expenses you incur

- Receive both a physical and a virtual card for purchases

- Annual Fee: $49

- You want credit card rewards without the need for a credit card

- You have little or no credit history

- You want to earn rewards for cash deposits into checking accounts

- You don’t plan on making ATM withdrawals

In-Depth Review: Point Card

The Point Card is a debit card that operates much the same way as a credit card but without impacting your credit score. The card from Radius Bank features up to 5X points on purchases for a $49 annual fee.

How Does Point Card Work?

The Point Card is similar to debit cards but emphasizes rewards more. Point Card describes itself as offering “rewards and benefits without the downsides of a credit card.” The card points on all purchases and various perks but forgoes the credit checks, monthly payments, and other charges typically found with a credit card.

How to Get the Point Card

Opening a Point Card account is simple. Applicants must download the card’s app and then follow the sign-up instructions through the interface. The experience is built around the service’s mobile app (available in both the Apple and Google Play stores).

Once the account is set up, the new user must fund the account to cover the annual fee ($49, billed in the initial deposit) and any other cash they want to be deposited. Users can activate their virtual debit card and order a physical one.

The Point Card is FDIC-insured for up to $250,000 through Sutton Bank, which also issues the Upgrade Card.

Eligibility

The Point Card is available to U.S. residents aged 18 and older. To open an account, users need a valid Social Security Number (SSN), current mailing address, and basic information (legal name, home address, etc.).

Point Card Guide to Rewards

Earn Impressive Rewards with Every Purchase

The major selling point of the Point Debit Card is the ability to earn up to 5X points on select purchases -something typically found in credit cards only. The card earns 5X on subscriptions for leading streaming services, including Netflix, Hulu, HBO Max, YouTube Premium, Spotify, Pandora, Feather, and Headspace.

The card also earns 3X points on food delivery, scooter, and rideshare purchases – including the usual culprits, such as DoorDash, Uber Eats, Postmates, Caviar, GrubHub, Seamless, Instacart, Good Eggs, Uber, Lyft, and Lime. All other purchases with the card – including ineligible rideshare, streaming, or delivery services – earn an unlimited 1x points per $1 spent.

Earn Bonus Points Through Partners

As stated, the Points Card thrives in its mobile app environment, including unique points offers with select retailers. Offers vary depending upon the user, location, and timeframe, but some retailers (including eateries) offer up to 10X points on purchases.

The bonus spending categories with the Point Debit Card aren’t unique to it – most banks and credit card issuers offer additional savings through partners. Still, it is a great feature that adds extra value to the Point Card.

How to Redeem Points

The Point Debit Card only offers one redemption method for reward points. Cardholders can only redeem points for cash deposited into their associated checking account. While this isn’t a great rewards program, it can help users save money with everyday purchases.

Credit Card-Level Protections

While Point Card is not a credit card, it does use the Mastercard payment network. Because of this, the card offers the types of perks and protections many users would expect from a World Mastercard product.

Point Debit Cardholders will enjoy the following Mastercard World Debit features:

- Phone insurance of up to $1,000 on phone plans purchased with the Point Card

- Car Rental and Trip Cancellation insurance

- Mastercard global travel assistance

- Mastercard Zero Fraud Liability coverage

- No foreign transaction fees

Comparisons

| Albert Mastercard® | GO2bank Visa® Debit Card | Yotta Debit Card | |

|---|---|---|---|

| Feature #1 | Earn $150 when you receive a qualifying direct deposit and use your Albert debit card | Overdraft protection up to $200 with opt-in and eligible direct deposit | The only debit card that could literally make someone a millionaire including odds up to 1 in 100 Yotta will cover your entire purchase |

| Feature #2 | Earn cash back rewards when you buy groceries, gas, food and more with your Albert debit card | Free nationwide ATM network Refer a friend, and you both get $50 | Earn 10% of your purchase amount back in the form of tickets into the following week’s sweepstakes |

| Direct Deposit | Get paid up to 2 days early | Get paid up to 2 days early | Get paid up to 2 days early |

What We Like About Point Card

There are plenty of positives with Point Card. Firstly, the card allows you to earn rewards on your everyday spending. Instead of simply making a purchase and receiving nothing in return, you can accumulate points that can be redeemed for valuable rewards.

Secondly, those rewards can help save you money. Many cards offer cash back rewards, which means you’ll receive a percentage of your purchases back in cash. Additionally, some cards offer travel discounts, allowing you to save money on flights, hotels, and rental cars.

Lastly, the card enjoys additional perks and benefits. These include access to exclusive events, concierge services, extended warranties on purchases, and even travel insurance, and they come courtesy of the Mastercard payment network. By taking advantage of these perks, you can enhance your overall consumer experience and enjoy added value from your card.

Drawbacks with the Point Card

While this product has plenty of good, there are also some factors to consider before applying for the card. There is no dedicated ATM network, for example. Point tries to compensate for this shortcoming through two free ATM withdrawals per month, but that is very weak – especially compared to other fintech debit cards, like the Aspiration Card, with over 55,000 fee-free, in-network ATMs.

Equally frustrating is the lack of direct deposit availability. Sure, unlimited bank transfers and insurance on deposits might be frustrating for those who want their paycheck to the Point Card.

The final major drawback (beyond the limited redemption methods) is the inability to build credit with the card. Rewards debit cards are great in that they avoid the negatives of credit cards but also lack the positives, including the chance to build credit.

Sutton Bank Ratings

How does Sutton Bank rate as a card issuer? Here is a selection of ratings for the bank from experts and everyday consumers:

| BestCards | Better Business Bureau | TrustPilot |

|

5/5 |

5/5 |

5/5 |

Should You Apply for the Point Card?

The Point Debit Card seems interesting – and is for a certain individual niche. The card offers up to 5X points (or more) on select purchases but struggles with redemption options, ATM access, or direct deposit capabilities.

The lack of a credit check is the card’s major selling point, especially as few debit cards are as lucrative as the Point Card. For those seeking to avoid hard inquiries on their credit report, the card is a great fit in their wallet – but only if they plan to spend heavily enough to offset the $49 annual fee.

Ultimately, the Point Debit Card is great for those nervous about credit cards, but struggle in the long term compared to even the most general rewards card. Those cards offer the chance to build credit, leading to impressive rewards without the annual fee in the future.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.