by Cory Santos | Last updated on September 30th, 2023

Disney Premier Visa Card

Disney Premier Visa Card

Disney Premier Visa Card

- 19.24% to 28.24% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 19.24% to 28.24% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

- 0% for 6 months after select Disney vacation package or real estate interest purchase in a Disney Vacation Club® Resort Intro Purchase APR

At a Glance

The Disney® Premier Visa® Card shines brightest when shopping and redeeming with Disney, offering plenty of perks and savings for enthusiasts of the Happiest Place on Earth.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- $300 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening

- Enjoy 0% promotional APR for 6 months on select Disney vacation packages from the date of purchase, after that a variable APR of 15.99%

- Save 10% on select Disney and Star Wars purchases at Disney store and shopDisney.com

- Receive 10% off select merchandise purchases of $50 or more at select locations at the Disneyland® and Walt Disney World® Resorts

- Earn 2% in Disney Rewards Dollars on card purchases at grocery stores, restaurants, gas stations and most Disney locations

- Earn 1% on all your other card purchases

- Redeem Rewards Dollars for a statement credit toward airline travel

- Intro Purchase APR: 0% for 6 months after select Disney vacation package or real estate interest purchase in a Disney Vacation Club® Resort

- Regular Purchase APR: 19.24% to 28.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 19.24% to 28.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Penalty APR: Up to 29.99% variable based on the Prime Rate

- Annual Fee: $49

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You often shop for Disney products

- You travel to Disney locations or book travel with Disney

- You wish to earn rewards and plan to redeem them towards Disney products

Disney Premier Visa Card

Terms & ConditionsThe Disney® Premier Visa® Card Review

The Disney® Premier Visa® Card from Chase will delight anyone who loves to visit the happiest place on earth. The card, ideal for Mouseketeers, earns unlimited Disney Rewards Dollars (DRDs) by merely making everyday purchases.

Statement Credit Sign Up Bonus

The Disney Premier Visa comes with a more significant statement bonus than the Disney Visa. That card receives a $100 statement credit after making $500 in purchases. The Premier, on the other hand, provides a $300 credit, but also requires a $1,000 spend on the card within the first three months.

How to Earn Rewards

The Disney Premier Visa offers additional rewards versus the no annual fee Disney Visa Card. Where that card earns a flat 1% back in the form of DRDs, the Premier earns extra rewards at Disney – and elsewhere.

Cardmembers earn a solid 2% back on Disney purchases, meaning the card offers exceptional value for those who are Disney annual pass holders or who plan on using the card for booking their next Disney trip.

Unlike the basic Disney Visa Card, the Premier also earns DRDs outside of Disney. Purchases at gas stations, grocery stores, and restaurants also earn 2% back, meaning the card offers significant value for those who want an everyday credit card to help finance their next family vacation.

Every other eligible purchase with the card earns 1% back.

How To Spend Disney Reward Dollars

Disney Reward Dollars have a value of approximately one cent per point. This means that cardholders would need to spend $100 on purchases with their card to earn just 1 DRD Fortunately, DRDs do have some flexibility in redemption, with Disney Rewards Redemption card award options including:

- Disney Hotels & Resorts –DRDs apply towards accommodations and room charges at most Disney Resorts (U.S. locations only).

- Theme Park Admission Tickets –DRDs apply to both general admission tickets and annual pass memberships at Disney Hollywood Studios®, Disney California Adventure® Park, and Disneyland® Park.

- Theme Park Vendors – Many park vendors and restaurants will accept Disney Reward Dollars as a form of payment. They will even return used reward dollars to your account in the event of a refund. This also includes additional in-park activities such as guided tours, photo passes, and more.

- Merchandise –Use DRDs at all Disney merchandise locations, as well as when shopping at ShopDisney.com.

- Disney Cruise Line –Use DRDs towards cruise bookings via DisneyCruiseLine.com or for onboard purchases, upgrades, or services.

- Movie Tickets – Disney partners with AMC theaters to allow cardholders to pay for tickets to Disney, Disney-Pixar, and Star Wars movie tickets.

Disney Rewards Dollars with the Disney Premier Visa also apply towards airline credits. This additional award category offers accounts the chance to offset the costs of flying to Orlando or Anaheim.

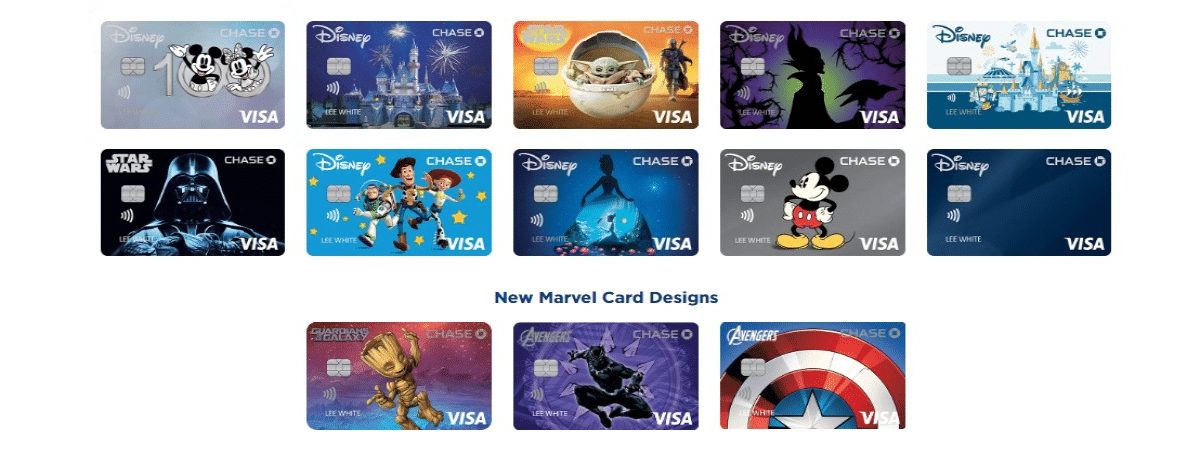

Choose Your Own Card Design

What good is a rewards credit card if you can’t look good while swiping? Fortunately, Chase and Disney have thought of every want and need with 13 exclusive card designs featuring all of your Disney favorites:

Special Disney Financing

The Disney Premier Visa Card comes with a unique 0% intro APR offer. Unlike other cards which offer no interest on balance transfers, the Disney Card provides new accounts with 0% APR for the first six months on select Disney vacation packages. This makes the card a decent option for those who are considering a family getaway to the Magic Kingdom, Disneyworld, or any other park – but want to save money for use on-site.

Marvel Unlimited Savings

Chase Disney Visa credit cardmembers receive 20% off the first year of an Annual Marvel Unlimited subscription as a new perk (effective 10/1/23), which includes:

- Digital access to over 30,000 Marvel comics, including those exclusive to Marvel Unlimited

- Upgrade membership to include an exclusive membership kit, including a limited-edition Marvel Legends action figure, pin, exclusive comic, and exclusive patches associated with recent brands or spotlighted IP.

Other Chase Disney Premier Card Benefits

The Premier Card also features the same 10% savings as the Disney Visa. Cardholders receive 10% savings on purchases at ShopDisney.com and any merchandise purchases of over $50 at Disneyland and Walt Disney World Resorts.

Which Disney Visa Card Is Right for You?

Not sure which Chase co-branded Disney Rewards credit card is right for you? Here is a quick breakdown of the two Disney credit cards to help give you a better idea:

| Disney Premier Card | Disney Visa Card | |

|---|---|---|

| Rewards | Earn 2% in Disney Rewards Dollars on card purchases at grocery stores, restaurants, gas stations and most Disney locations | Earn 1% in Disney Rewards Dollars on all your card purchases with no limits to the amount you can earn |

| Welcome offer | $300 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening | $150 Statement Credit after you spend $500 on purchases in the first 3 months from account opening |

| Annual fee | $95 annual fee | No annual fee |

Disney Visa Card FAQs

Here are the answers to some of the more commonly asked questions about the Disney® Visa® Cards from Chase:

- Chase credit cards typically require good or excellent credit. Applicants will usually need a credit score of at least 670 to be in with a shot of getting approved for a Chase credit card. Of course, there are always exceptions, so you never know if you have a lower score.

The 5/24 rule applies specifically to applicants who wish to open a new personal credit card with Chase. In a nutshell, the 5/24 rule stipulates that, if your account shows five or more credit card applications (which involve a hard inquiry each time you apply for a card) within the last 24 months, your credit card application will be rejected by Chase.

This rule applies to all personal credit cards and applications, from any bank or card issuer, that may appear on your credit report – not just to applications with Chase. This is an internal rule, one that Chase does not formally publish in their terms and agreements or via any official announcements; it came to light after people began to notice that they were denied for credit cards through Chase and took to online forums to discuss the reasons why, and to compare their experiences.

- Check out The Chase 5/24 Rule: What You Need To Knowfor more information.

- Chase offers several Disney discounts through its Disney Debit (as outlined above) and the two Disney co-branded credit cards: the Disney Visa and Disney Premier Visa.

JP Morgan Chase Banking Ratings

How does the Chase Disney Debit and Total Checking stack up? Here are a selection of expert reviews for the card, as well as an overview of JP Morgan Chase as a bank:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

3.5/5 |

2/5 |

Should You Apply for the Disney® Premier Visa® Card?

While the $59 annual fee may turn away some potential applicants, it really shouldn’t. The Disney® Premier Visa® Card is the perfect card for those who love Disney and love to visit the Happiest Place on Earth.

Those planning a trip can save serious money with everyday purchases thanks to the 2% back on gas, groceries, and dining. The additional 10% savings on select Disney purchases, plus the 0% intro APR financing on Disney vacations, are also excellent benefits that provide families with real value.

Overall, the Disney® Premier Visa® Card isn’t for everybody. But, for those who either love Disney or wan to save money for a family vacation for their kids who love Disney, the card is an excellent option to consider. For those looking for more general rewards card, the Citi Premier® Card and Chase Sapphire Preferred feature similar annual fees and more versatile rewards.

Browse Other Chase Credit Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.