by Cory Santos | Last updated on January 28th, 2024

Grow Credit Mastercard

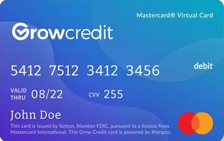

Grow Credit Mastercard

Grow Credit Mastercard

- 0.00% Regular Purchase APR

- 0.00% Balance Transfer APR

- 0.00% Cash Advance APR

At a Glance

Better credit through streaming? That's Grow Credit's interesting approach, where you could see your credit score go up simply by paying for your monthly entertainment subscriptions. Although limited in its abilities, Grow Credit's virtual Mastercard has one main goal: to improve your credit standing with the help of something you're likely already paying for.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Grow Credit reports customer activity to the three major credit bureaus each month – which can help you establish, build, or grow your credit over time

- Choose from over 100 available subscription services to pay with Grow Credit

- Multiple membership plans to choose from – granting you enhanced benefits such as prmium subscriptions access & cell phone bill payment

- You can join Grow even if you have a limited or no credit history

- Regular Purchase APR: 0.00%

- Balance Transfer APR: 0.00%

- Cash Advance APR: 0.00%

- You want to establish or build up your credit standing

- You have multiple subscription services that you pay for on a regular basis

- You prefer to have all your subscriptions under the same payment method with minimal fuss

In-Depth Review: Grow Credit Mastercard

Establishing a strong credit history can be challenging if you are new to credit or nervous about opening an unsecured credit card account. Fortunately, Grow Credit hears you and provides its Grow Credit Mastercard to effortlessly help users build credit by getting credit for the subscriptions that they already pay each month.

What is Grow Credit?

Grow credit is one of many alternative ways to build credit. The service gives you credit for paying the subscriptions you already have. The service works with many subscription services, including cellular phone and internet plans, with major providers like Xfinity, Cox, US Cellular, Visible, Metro, T Mobile, Cricket, Spectrum, Boost, and more. Please note that these cellular providers are only available on the Accelerator plan (more on that soon).

Is My Subscription Eligible?

Beyond those service providers, here is a full list of eligible subscription services that work with Grow Credit – it’s a big one:

| Dollar Shave Club | Max | Hulu | Netflix | Pandora |

| Playstation | Spotify | XBox Live | ESPN+ | Paramount+ |

| Showtime | i Heart Radio | Disney+ | YouTube Premium | Tidal |

| Ring | Funimation | Ipsy | Crunchyroll | BET+ |

| SiriusXM | WWE Network | Peacock | VRV | Office 365 |

| Kindle Unlimited | DoorDash | Billie | Boomerang | Discord |

| AMC+ | Canva | Gaia | Gamefly | Mint Mobile |

| NYT | Pantaya | Patreon | Peloton | Plex |

| Pureflix.com | Soundcloud | Splice | Zeus | Chegg |

| Convert Kit | Postmates | Uber Eats | Treads | GrubHub |

| Play | Dropbox | Nvidia | Humble Choice | Curiosity Stream |

| NBA League Pass | UPlay | Twitch | Mode | |

| Rental Verification | NordVPN | Linguix | Nat Geo | AARP |

| Flexibits | Mondly | Grammarly | Dovly | Blue Apron |

| Sling | DirectTV | Coursera | JustFab | Philo |

| Xfinity | Adobe | Boxy Charm | Bark Box | AAA |

| Fab Fit Fun | Shoedazzle | Keeps | Shopify |

The service reports your monthly payments to these streaming services to all major credit bureaus – Experian, Equifax, and TransUnion. On average, Grow Credit claims users can boost their credit score by 44 points. This is similar to the growth experienced by Experian Boost customers, potentially making the two programs a one-two punch of credit building.

The Grow Credit Mastercard program helps build credit score in several ways:

- Lowers credit utilization: Automatically having your balance paid in full every month creates a solid payment history, which is 35% of your FICO score.

- Adds a credit account: If you currently have no credit history, Grow can help you start the clock on your average length of credit history, which is 15% of your FICO score.

- Improves credit mix: Grow further boosts your credit history by adding a new line of credit to your credit mix. Credit mix accounts for 10% of your FICO score.

How to Get Grow Credit

Getting Grow Credit is simple and straightforward. New users can download the Grow Credit app from the Apple App Store, the Google Play App Store, or the Grow Credit website.

No Credit Check to Apply

From there, getting Grow Credit is as easy as submitting a quick application. Don’t worry; there is no hard inquiry with the card. While this doesn’t exactly mean “no credit check,” there is only a soft credit pull when applying for Grow Credit. This means there will be no negative impact on your credit score just for applying.

Application Requirements

Applying for the Grow Credit Mastercard requires the following information:

- Bank account in your name

- Valid email address

- Valid phone number (text messages required)

- Social Security Number (SSN)

- You must be a permanent United States resident with a physical address in one of the 50 states or D.C.

- You must be at least 18 years of age

You can join Grow with no credit history or limited credit.

Grow Credit Card Types

Standard

The Grow Credit standard plan is free to join. Apply and add at least one of the supported subscriptions to your credit score. This free tier is limited to $17 in monthly spending, so it likely won’t suit anyone with multiple streaming accounts they want to get credit for.

Secured

If you don’t have a bank account in your name, you can still qualify for the Grow Credit plan through a secured account.

The Grow Credit Secured Card requires a deposit but allows you to earn credit through your usual subscription services. With this tier, you select your deposit amount and use those funds to open a secured card account.

Grow Credit refunds your deposit after 12 months of consecutive on-time payments or in the event your Secured account is closed. Secured accounts enjoy the same credit reporting as the free, standard plan.

Grow Credit Paid Plans

While there are two card types with Grow Credit, there are three distinct membership tiers: Build, Grow, and Accelerate. Here’s how those three plans compare:

| Build | Grow | Accelerate | |

|---|---|---|---|

| Cost | Free | $4.99/month | $9.99/month |

| Credit reporting | Yes | Yes | Yes |

| FICO Score access | Yes | Yes | Yes |

| Auto payments | Yes | Yes | Yes |

| Premium subscription access | No | Yes | Yes |

| Phone bill access | No | No | Yes |

No Fees

You don’t have to worry about carrying a balance with the Grow Credit Mastercard – there is none. The card doesn’t allow carrying a balance, meaning there is no APR, no late payment penalties, and no hidden fees to worry about. The card only works for charging the subscriptions you currently have.

Mastercard Protections

As a Mastercard product, Grow Credit cardholders have access to essential Mastercard safety protections and features, including:

| Zero Liability Protection | Mastercard Global Services | ID Theft Protection |

Credit Builder Comparison

| Grow Credit Mastercard | Current Build Card | GO2bank Visa® Debit Card | |

|---|---|---|---|

| Credit check | None | None | None |

| Maintenance fee | See plans | $0 | $5 (waived with direct deposits) |

| Monthly credit reporting | Yes | Yes | No |

| Rewards | N/A | Up to 7X | N/A |

What We Like About Grow Credit

There’s plenty to like about Grow Credit.

Build Credit without a Credit Card

Grow Credit is like many other credit builder services, giving you credit for many of the services you already use. In this regard, the card is like the Experian Smart Money™, which tracks utility payments. Unlike that card, Grow Credit works with subscription services and phone plans, providing an additional avenue of attack. With Grow Credit, in addition to Experian Boost (also free to use), the process for quickly boosting your credit is almost foolproof.

Free Version

While the free version of the Grow Credit program is capped at $17 per month in sending, it is ideal for those who want to build credit but don’t want to pay $60 annually for a paid plan. That free account is ideal for those with one or two subscriptions (depending on the cost. Put simply, it’s nice to get something for free for a change.

Things to Consider

Small Spending Limit with Basic Plans

One of the biggest downsides with Grow Credit is the rather paltry spending caps it puts on the lower-priced plans. For instance, the Build plan, the basic plan caps spending at $17 per month. Only when you opt for the Accelerate plan will you get plenty of spending power to boost your credit score. That tier offers up to $150 monthly, equating to 10 to 15 monthly subscriptions.

Here are the spending caps for all the tiers:

- Build: $17 per month (designed for one subscription)

- Grow: $50 per month (great for users with 2-to-3 subscriptions)

- Accelerate: $150 per month (ideal for those with subscriptions and phone plans)

Sutton Bank Ratings

The Grow Credit Mastercard is issued through Sutton Bank, member-FDIC. Here are a selection of ratings for the bank from experts and the public:

| BestCards | Better Business Bureau | TrustPilot |

|

5/5 |

5/5 |

5/5 |

Should You Apply for the Grow Credit Mastercard?

Is the Grow Credit Mastercard right for you? That depends on just how much you want to boost your credit. The card’s free tier is ideal for those who want to casually improve their credit profile but don’t want the stress and interest charges of a credit card. Grow Credit tracks more than 70 different subscription and recurring payments and reports those on-time payments to the three major credit reporting agencies – Experian, Equifax, and TransUnion.

For those looking to quickly grow their score, the Accelerate plan is just that – a fast track to a FICO boost. The spending cap, $150 per month, is very generous and can account for up to ten accounts depending on your subscription plan costs. Combined with Experian Boost for those with rent payments, gym memberships, or other recurring payments, this platform can increase your credit substantially. Grow Credit states an average of 44 points but combined with responsible credit use and other credit booster apps and services, the sky is the limit.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.