by Cory Santos | Last updated on December 11th, 2023

Walmart MoneyCard Visa

Walmart MoneyCard Visa

Walmart MoneyCard Visa

At a Glance

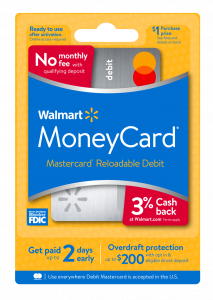

The Walmart MoneyCard is a prepaid Visa debit card from Walmart that offers cash back rewards on select purchases, access to a full selection of checking and savings features, and more – for as low as $0 per month.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Get $20 this season when you make two new direct deposits of $500+ by 6/30/22.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

- *Please see site for full terms and conditions.

- Annual Fee: None. $5.94 monthly fee

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Minimum Deposit Required: See Terms

- You frequently shop at Walmart

- You frequently purchase gasoline at eligible Walmart stores

- You get your groceries delivered from Walmart

- You want a small savings account that earns up to 2% APY

- You plan to add accounts for family members

Walmart MoneyCard Visa Debit Card Review

The Walmart MoneyCard Visa is an innovative checking and debit program from Walmart – one of nation’s largest retailers. The card program offers a full suite of banking features, including overdraft protection, up to 2% APY on savings, and cash back rewards – all for no monthly fees when meeting direct deposit requirements.

The card is issued by Green Dot Bank, one of the premier debit card issuers in the United States. Green Dot also issues the GO2bank Visa® Debit Card.

How to Get the Walmart MoneyCard

Getting your hands on a Walmart MoneyCard is fairly easy. The card is available both online and in-store at Walmart locations nationwide. Purchasing the card in-store at Walmart involved going to the customer service desk, buying a card (with a one-time $1 purchase price), and loading the card.

Ordering a card online is even easier. Simply click the “apply now” button above, provide the typical information, and open an account. The application requires the following information:

- Name

- Date of birth

- Address

- Contact information (phone number, email)

- Social Security Number (SNN – for identification purposes)

- IRS tax form W-9 (for finance verification)

Earn Cash Back at Walmart

One of the great features of the Walmart MoneyCard is the ability to earn up to 3% cash back rewards on purchases. Cardholders earn the rewards for the following purchases made at Walmart locations:

- 3% back at Walmart.com

- 2% back at Walmart fuel stations

- 1% back in-store at Walmart locations

Even though Walmart caps the cash back rewards to $75 per year, the Walmart MoneyCard compares favorably to the Capital One® Walmart Rewards™ credit card from Capital One. That card earns an unlimited 5% back at Walmart.com, 2% in-store at Walmart, plus at Murphy USA fuel stations and Walmart fuel stations, and 2% back on dining and travel.

Capital one’s Walmart credit card also comes with a hard inquiry and might be out of reach for many, making the Walmart MoneyCard a great option for the frequent Walmart shopper that wants to save on grocery deliveries, in-store purchases, and even gas – but doesn’t want the hassle of a credit card.

Cash back rewards are automatically debited to the card account.

Tax Refund Bonus

New Walmart MoneyCard accounts can also take advantage of a special tax season bonus. Accounts receive a $20 bonus when they direct deposit their federal tax return to the account and receive at least a $500 direct deposit by June 30, 2022.

ASAP Direct Deposits

The card also offers access to ASAP Direct Deposit. This feature lets account holders receive their paychecks up to two days early and benefits up to four days early. This feature isn’t unique to the card, but it is a nice feature for those who like the flexibility to get paid early.

Overdraft Protection

The card also offers overdraft protection of up to $200, an excellent feature for a prepaid debit account. The overdraft feature requires opting into the savings account and submitting eligible direct deposits. Additionally, the overdraft protection applies to purchases only, not other transactions.

High-Yield Savings Bonus

As mentioned, the Walmart MoneyCard is more than just a prepaid debit card. The card offers a full suite of banking options – including a high-yield savings account. Cardholders can use the savings account in the Walmart MoneyCard mobile app to stash cash for safekeeping, emergencies, or future purchases.

Cardholders can also earn 2% APY on up to $1,000 in their savings account. This savings rate is exceptional – with the average APY on a savings account currently 0.06% APY. If the limit of $1,000 seems frustrating, keep in mind that this might be a great way to save a small emergency fund for unforeseen circumstances.

Limited-Time Savings Bonus

The card account also comes with the possibility of a $1,000 prize each month. Every month account holders are automatically entered for chances to win one of 1,000 cash rewards through Walmart’s Prize Savings Sweepstakes.

To be eligible for the promotion, you simply need to use the savings account feature and either transfer funds from the Walmart MoneyCard account to the in-app Walmart MoneyCard Savings Account or send a mail-in entry to the following address: PO Box 251328 West Bloomfield, MI 48325. The Prize Savings Sweepstakes ends on April 30, 2022.

No Monthly Fees – for Some

Prepaid debit and banking accounts typically feature some form of fees, but with the Walmart MoneyCard there are no monthly maintenance or service fees when meeting minimum requirements. With the MoneyCard, those requirements are direct depositing at least $500 to the account in the previous month.

That $500 deposit requirement is very modest – and can easily be accomplished by having at least one paycheck or benefits payment made to the account. This, in turn, provides access to the high-yield savings account, cash back rewards, and more – for no annual or monthly fees.

The monthly service fee for the Walmart MoneyCard is $5.94 for those not meeting deposit requirements. This fee, however, is pretty reasonable – especially when considering that the card provides additional accounts for free for up to four approved members ages 13+, in the app, with the activated, personalized card.

Other Card Features

Other notable features of the Walmart MoneyCard include the purchase protections that come from a Visadebit card. These perks and protections include:

- Visa Zero Fraud Liability protection

- Comprehensive fraud monitoring

- Lost or stolen card replacement

FAQs

Here are some frequently asked questions about the Walmart MoneyCard program, as well as the answers:

- You can get a MoneyCard account either online or in-store. Ordering online takes two weeks but saves the hassle of purchasing and loading the card at Walmart locations.

- You must be at least 18 years of age to open a Walmart MoneyCard account.

- You can reload or add money to the MoneyCard at the following locations or through the following methods:

- Using the Walmart MoneyCard mobile app

- Walmart Rapid Reload

- MoneyPak

- Walmart cash and load e-checks

- This feature is only available on the Walmart MoneyCard with Cash-Back Rewards program.

Card Availability

The Walmart MoneyCard program is available in all 50 U.S. states and the District of Columbia.

Walmart MoneyCard Expert Ratings

How does the Walmart MoneyCard stack up? Here are a selection of expert reviews for the card and Green Dot Bank – the card’s issuer:

User Rating

User Testimonials

What is the MoneyCard from Walmart like to live with? Before deciding if the card is right for you, here’s what our readers and members think about the card and company:

Should You Consider Getting the Walmart MoneyCard Visa Debit Card?

Overall, the Walmart MoneyCard account has plenty to offer – and comes with no charge for those who plan to take advantage of those features. The card features up to 3% back at Walmart and 2% APY on savings – a one-two punch that is sure to entice applicants. Add to that Visa protections, overdraft coverage for up to $200, and more, and you have the versatility to earn – and save – all in one convenient card.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.