Last updated on September 21st, 2023

Bad credit scores impact many aspects of daily life. Having a low credit score can keep you from obtaining a mortgage, finding an apartment to rent, or even preventing you from getting a credit card. While those with an excellent or low credit score likely know where they stand, for those in between the situation gets murkier. Do you ever find yourself wondering, “Just how bad is my credit score?” Here’s what you need to know:

What Is a Bad Credit Score?

Credit scores range from about 300 to 850 – depending on the credit scoring model used – with a higher score meaning better credit. There are two major credit scoring systems, FICO and VantageScore. FICO is the oldest – and most widely-used – scoring model, while VantageScore is a relatively new model.

What is a Bad FICO Score?

A credit score between 300 and 579 is considered “bad” in the FICO Score model. According to Experian, one of the three major credit reporting bureaus (the others being Equifax and TransUnion), 16% of Americans suffer from a bad credit score. Of those with poor credit, the vast majority have a credit score in the 500s. Only those with severely damaged credit, or no credit history at all, will have a score in the 300s.

What is a Bad VantageScore?

VantageScore differs from FICO in that it places greater emphasis on newer credit. That said, the model is similar regarding the range of scores, though the model breaks them down into “poor” and “very poor.” A Vantage Score of 300 to 499 is very poor, while a score between 500 to 600 is considered poor.

What Are the Negatives of Having Bad Credit?

Poor credit makes it much tougher to get approved for loans. Bad credit scores make banks unlikely to accept applications for credit cards, personal loans, mortgages, and auto loans. Where those with a bad score can find a lender, they will only offer higher interest rates. With high interest, the cost of servicing those loans can quickly overwhelm a budget, leading to financial hardships.

Bad credit also impacts other areas of life. Employers and landlords can access an applicant’s credit report to gauge their suitability for a job or apartment. Poor credit can make it difficult to land a dream job or get that new apartment because they pose too much of a risk. Poor credit also raises insurance premiums – and can cause insurers to cancel policies.

What Factors Impact Your Credit Score?

What are the items and factors that influence FICO scores? And what factors influence a VantageScore?

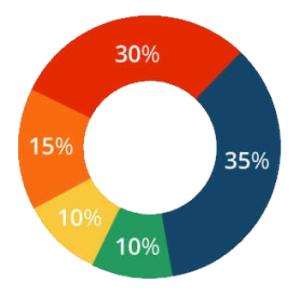

FICO Score

FICO places significant weight on payment history, as this is the biggest indicator of a person’s ability to repay any new credit they may receive. Nearly as important is the amount of available credit that individual is currently utilizing, which makes up 30% of the score. Of less significance (but still important) are the types of credit a person has, the number of hard inquiries they have in the past 12 months, and the length of their overall credit history.

| FICO Scoring Factor | % of Score |

| Payment history/ late payments | 35% |

| Total amount owed on credit accounts | 30% |

| Average length of credit history | 15% |

| Types of credit accounts | 10% |

| New credit applications (hard inquiries) | 10% |

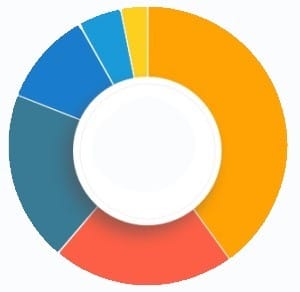

VantageScore

The VantageScore model places a much greater emphasis on types of credit (or credit mix) than FICO. Equally important, however, is payment history.

| VantageScore factor | % of Score |

| Payment history/ late payments | 40% |

| Credit depth | 21% |

| Credit utilization | 20% |

| Total balances | 11% |

| Recent credit | 5% |

| Available credit | 3% |

What Can I Do to Fix My Bad Credit?

While bad credit is a serious financial issue, it is also one that is fixable. Here are some of the proactive steps you can take to improve your finances and boost your credit score.

Use a Credit Monitoring Service

One of the simplest ways to begin improving your credit score is by signing up for a credit monitoring service. Using a monitoring service, like MyFICO or TransUnion, can help you see exactly what your credit score is and provide you with concrete steps to boosting it – fast.

Consolidate or Refinance Your Debts

Those struggling with debt should also consider applying for a debt consolidation loan to eliminate multiple monthly payments into one, simple-to-manage payment. Alternatively, discuss refinancing options with your current lenders to try and reduce your monthly payments.

Find a Fresh Start Unsecured Credit Card

While not every bank is willing to take a chance on someone with bad credit, there are still some good credit card offers for those repairing their credit score. Known as “subprime” credit cards, or “fresh-start” cards, these cards typically come with higher interest rates and lower credit limits.

Using these cards sparingly and paying the balance in full each month, however, can quickly boost your credit score. Even better, some cards, like the Reflex Platinum Mastercard®, offer the chance of a higher credit limit with responsible use.

Some of the best unsecured credit cards for bad credit include:

| Surge® Platinum Mastercard® | Applied Bank® Unsecured Classic Visa® Card | FIT™ Platinum Mastercard® | |

|---|---|---|---|

| Card type | Unsecured | Unsecured | Unsecured |

| Starting limit | Up to $1,000 | $300 | $400 |

Get a Secured Credit Card

Those struggling to get an unsecured credit card may also decide on a secured credit card to boost their poor credit. Secured credit cards differ from unsecured cards in that they require a deposit that acts as both collateral for the credit line, and as the credit limit. A $200 deposit, for instance, yields a $200 credit limit.

Secured cards are great because they are among the easiest credit cards to get, making them perfect for those with poor credit. And, with proper use, you can boost your credit score quickly.

The best way to use a secured card is only to use the card for smaller purchases. This practice keeps the credit utilization rate low – ideally below 10%. Keeping your credit use under 10% is the fastest way to raise your score. Equally important, however, is paying the statement balance in full each month – doing so can help you upgrade to an unsecured card in no time.

Some cards, however, like the First Progress Platinum Prestige Mastercard® Secured Credit Card, offer exceptionally-low APRs, making them perfect for building credit and carrying a balance.

Some of the top secured credit cards for bad credit scores are:

| Card | Features | Annual fee |

|---|---|---|

| First Progress Platinum Elite Mastercard® Secured Credit Card |

|

$29 |

| OpenSky® Secured Visa® |

|

$35 |

| Self Visa® Credit Card |

|

$25 |

| First Progress Platinum Select Mastercard® Secured Credit Card |

|

$39 |

Summing It Up

A bad credit score can severely impact your life – but only if you let it. While poor credit is a problem, it is one with a simple solution that takes time and patience to achieve.

Actively monitoring your credit score, improving it with debt consolidation, and learning good financial habits are essential to eliminating the issue of bad credit once and for all. Get the right credit card, keep your credit utilization low and pay your balance on time, and your poor credit score will soar in no time!

Related Article: Easiest Credit Cards to Get with Bad Credit

FICO and VanatgeScore images courtesy of RewardsExpert.co

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.