by Cory Santos | Last updated on November 13th, 2023

Southwest® Rapid Rewards® Performance Business Credit Card

Southwest® Rapid Rewards® Performance Business Credit Card

Southwest® Rapid Rewards® Performance Business Credit Card

- 21.24% to 28.24% variable Regular Purchase APR

- 21.24% to 28.24% variable Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

When growing your business, traveling to trade shows, meeting clients, and networking can be crucial to your success; using a business airline rewards card that earns points from travel purchases can really make a difference. The Southwest® Rapid Rewards® Performance Business Credit Card, which offers up to 4X unlimited Rapid Rewards® points on business purchases and spending with Southwest Airlines®, as well as a suite of generous perks and benefits, is a great candidate for small business owners.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 80,000 points after you spend $5,000 on purchases in the first 3 months from account opening and an additional 40,000 points when you spend $15,000 in 9 months.

- 9,000 bonus points after your Cardmember anniversary.

- Earn 4X pts on Southwest® purchases.

- Earn 3X points on Rapid Rewards® hotel and car rental partners.

- Earn 2X points on rideshare.

- Earn 2X points on social media and search engine advertising, internet, cable, and phone services and 1X points on all other purchases.

- 4 Upgraded Boardings per year when available.

- Member FDIC

- Regular Purchase APR: 21.24% to 28.24% variable

- Balance Transfer APR: 21.24% to 28.24% variable

- Balance Transfer Transaction Fee: Either $5 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $15 or 5% of the amount of each cash advance, whichever is greater

- Penalty APR: Up to 29.99% variable based on the Prime Rate

- Annual Fee: $199

- Late Payment Penalty Fee: $40

- Return Payment Penalty Fee: $40

- You're a small business owner who frequently flies with Southwest Airlines®

- You want to earn up to 4X points on travel and business purchases

- You will take advantage of the chance to earn 80,000 bonus points by spending $5,000 on purchases in the first three months

Southwest® Rapid Rewards® Performance Business Credit Card

Terms & ConditionsSouthwest Rapid Rewards® Performance Business Credit Card Review

The Southwest Rapid Rewards® Premier Business card offers more value as a travel rewards card than a business credit card. Still, for the jet-setting proprietor, it’s a worthwhile payment option.

Introductory & Annual Points Bonus

The Performance Business Visa from Southwest and Chase pleases eyes (and account managers) from the very start. New accounts can earn a whopping 80,000 Bonus Points after you and your employees spend at least $5,000 on eligible purchases within the first three months of account membership. That target is fairly modest – and especially so if you plan on issuing multiple employee cards to your team. And, even better, those employee cards are free of charge.

This welcome offer has a cash value of around $900 when booking an award flight with Southwest – and with 121 destinations dotted across North America, Central America, South America, and the Caribbean, there’s certain to be a destination that you (or your employees) can easily redeem those points.

There’s also a 9,000-point anniversary bonus simply for being a Southwest business card member. If you’re close to the minimum for a particular award redemption – and the timing is right – the bonus is a welcome boost that isn’t tied to any further purchases.

How to Earn Points

The Performance Business Visa provides companies with robust bonus categories to maximize Rapid Rewards points. The card provides the same categories of the Rapid Rewards® Premier Business Card with the added bonus of another business-specific category.

Cardholders earn an impressive 4X pts. on Southwest purchases, including base fares, incidentals, in-flight purchases, and baggage. Cardholders also earn 3X points on Rapid Rewards hotel and car rental partner purchases and 2X points on key travel and commuting categories:

- Social media and search engine advertising, internet, cable, and phone services

- Local transit and commuting, including rideshares

All other purchases with the card earn 1X points per dollar spent. Rapid Rewards points never expire, so you don’t have to worry about missing out on your dream flight just because miles might expire.

How to Redeem Points

Southwest Airlines prides itself on its straightforward approach to air travel – and the Rapid Rewards frequent flyer program is no different. Southwest Rapid Rewards points are redeemable for award flights with Southwest, with four distinct tiers: Wanna Get Away, Wanna Get Away Plus, Anytime, and Business Select.

Southwest teams with hotel, car rental, and other partners to help members maximize their value for money. Other options for redeeming points include making bookings with Southwest partners. Other redemption options include gift cards, merchandise, event access, or statement credits to the Southwest Rapid Rewards Premier Business Credit Card account.

Related Article: The Ultimate Southwest Rapid Rewards Program Guide

Southwest Rapid Rewards Business Credit Card Comparison

Not sure which Rapid Rewards small business credit card from Chase is right for your personal needs? Here is a quick breakdown of the cards:

| Southwest Rapid Rewards® Premier Business Credit Card | Southwest® Rapid Rewards® Performance Business Credit Card | |

|---|---|---|

| Rewards rate | Earn 3X points on Southwest purchases; 2X on Rapid Rewards hotel and car rental bookings, local transit and commuting including rideshare, plus social media and search engine advertising, internet, cable, and phone services; and 1X on all other purchases | Earn 4X points on Southwest purchases; 3X on Rapid Rewards hotel and car rentals; 2X on local transit and commuting, including rideshare, plus social media and search engine advertising, internet, cable, and phone services; and 1X on all other purchases |

| Best perk | 2 EarlyBird Check-Ins per year | Global Entry or TSA Pre✓® application fee credit |

| Annual fee | $99 | $199 |

Southwest Perks

The Performance Business Card provides an impressive selection of Southwest Airlines and other travel perks that will put a smile on your employee’s faces. When the Performance Visa purchases in-flight or terminal Wi-Fi, these perks start with up to 365 InFlight Wi-Fi credits per year. There are also four upgraded boardings per year when available per cardholder.

Accountholders also enjoy $500 in fee credit for points transfers when they use your Rapid Rewards Business Visa to transfer points to another Rapid Rewards member, any fees associated with the transfer will be reimbursed – up to $500 in statement credits per anniversary year.

Finally, cardholders enjoy security fast-track thanks to a Global Entry or TSA PreCheck® every four years. All cardholders receive a statement credit of up to $100 every four years as reimbursement for the application fee for Global Entry, TSA PreCheck®, or NEXUS when they use their card.-*

Earn 1,500 TQPs for Every $10K in Spending

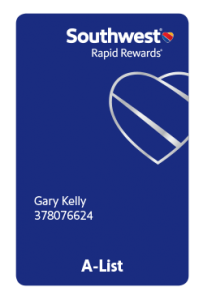

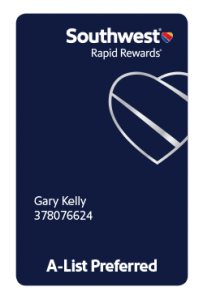

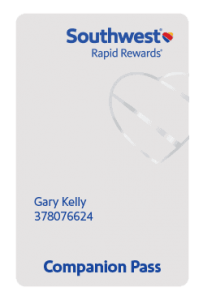

You’ll also earn 1,500 tier qualifying points (TQPs) toward A-List status for every $10,000 spent – with no limit on the amount of TQPs you can earn. TQPs apply towards ekite status within the Rapid Rewards program, with higher tiers providing better benefits:

| Southwest Rapid Rewards Tiers | |||

|---|---|---|---|

A-List |

A-List Preferred |

Companion Pass |

|

| Requirements | 35,000 TQPs or 25 flights. | 70,000 TQPs or 50 flights. | 135,000 CPQPs or 100 flights. |

| Mileage bonus | 25% | 100% | – |

| Free bags | 2 | 2 | 2 |

| Priority check-in | ✔️ | ✔️ | ✔️ |

| Priority security & boarding | ✔️ | ✔️ | ✔️ |

| Same-day changes | Free | Free | Free |

| In-flight Wi-Fi | – | ✔️ | ✔️ |

| Companion flies free | – | – | ✔️ |

Other Card Features

Other features of the Southwest Rapid Rewards Performance Business Credit Card include:

- No foreign transaction fees

- EMV chip technology and mobile wallet compatibility with Apple Pay, Google Pay, and Samsung Pay

- Complimentary employee cards

- $199 annual fee (applied to first billing statement)

Cardholders also enjoy partner benefits from Chase and Visa. First, Chase provides access to a one-year complimentary DashPass, a membership for DoorDash and Caviar. On the other hand, Visa provides comprehensive business protections and benefits designed to keep your company safe. These features include Lost Luggage Reimbursement and more:

| Zero Fraud Liability | Roadside Dispatch | Cardholder Inquiry Services | Purchase and Extended Protection |

| Lost/Stolen Card Reporting | Emergency Card Replacement | Auto Rental Collison Damage Waiver | Travel and Emergency Assistance Services |

FAQs About Southwest Rapid Rewards

Here are some of the most commonly asked questions regarding Southwest’s Rapid Rewards loyalty program:

- Yes. According to Southwest, you can request past flight points for up to 12 months after your flight. To claim points for a past flight, simply log into your account, select My Account and choose the Manage tab within My Rapid Rewards. Choose Request past points in the grey bar and enter your record locator (confirmation number) from your reservation. After verification of your flight information (up to 5 days), points will be deposited into your account.

- Rapid Rewards Dining is a rewards program within the Rapid Rewards program. This features lets members earn points from dining with select Southwest restaurant partners.

Related Article: Dining Programs: How to Earn Airline Miles with Any Credit Card

Chase Ratings

Here is a selection of expert reviews for the card, as well as an overview of JP Morgan Chase as a bank:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

3.5/5 |

2/5 |

Should You Apply for the Southwest Rapid Rewards® Performance Business Credit Card?

Business owners who are willing to invest their money towards top-tiered travel rewards each year certainly won’t want to miss their flight. Although the Southwest® Rapid Rewards® Performance Business Credit Card from Chase has an annual fee of $199, once you reach altitude you’ll be cruising with all of the perks and benefits that accompany this card’s top rewards-earning potential

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.