by Cory Santos | Last updated on April 12th, 2024

Delta SkyMiles® Debit Card

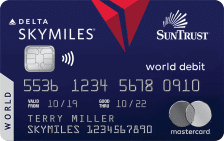

Delta SkyMiles® Debit Card

Delta SkyMiles® Debit Card

At a Glance

The Delta SkyMiles® Debit Card from SunTrust Bank is a co-branded airline rewards debit card that offers a 5,000 SkyMiles sign-up bonus, basic miles on everyday purchases, and more – for a variable annual fee (which SunTrust, now Truist, waives for the first year).

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- No annual fee for the first year

- Earn 1 miles for every $2 spent on eligible purchases

- Miles never expire

- Annual Fee: $0 for the first year, up to $95 after that

- Minimum Deposit Required: $100

- You bank with Truist

- You’re an existing Delta SkyMiles member

- You’re not looking for a credit card

- You meet the requirements for Truist Advantage Preferred

At a Glance

The Delta SkyMiles® Debit Card from SunTrust Bank is a co-branded airline rewards debit card that offers a 5,000 SkyMiles sign-up bonus, basic miles on everyday purchases, and more – for a variable annual fee (which SunTrust, now Truist, waives for the first year).

Ideal for Those Who:

- Bank with SunTrust

- Are an existing Delta SkyMiles member

- Don’t want a credit card

- Meet the requirements for SunTrust Advantage Preferred

Delta SkyMiles® Debit Card Review

The SunTrust Delta SkyMiles® Debit Card is an intriguing airline rewards debit card that provides an introductory SkyMiles bonus offer, miles on everyday purchases, and more. The card requires a SunTrust Advantage Checking account to open and features an annual fee as low as $25 (waived for the first year).

Introductory SkyMiles Bonus

The Delta SkyMiles Debit Card from SunTrust comes with an easy-to-reach sign-up bonus. New accounts enjoy a 5,000 SkyMiles bonus after making their first qualifying purchase. “Qualifying purchases” includes PIN and signature-based purchases, internet purchases, phone or mail order purchases, or automatic bill payments. Delta SkyMiles have an approximate value of 1.2 centers per point, making this sign-up bonus a $60 value.

Earn Miles with Everyday Purchases

The card also earns miles with all eligible purchases. The earning rate for the card is one mile for every $2 spent on purchases – or 0.5 points per dollar spent.

While that rewards rate is far inferior to most Delta credit cards, those cards (from American Express) might not be accessible to all consumers. For the SunTrust customer with no credit history or bad credit, the SunTrust Delta SkyMiles® Debit Card might provide the ideal pairing with an existing SkyMiles account to boost miles-earning on everyday purchases.

How to Redeem Miles

SkyMiles earns with the SkyMiles Debit Card from SunTrust never expire, with miles redeemable through the usual methods, including:

- Delta award travel

- Seat upgrades on Delta-operated flights

- Delta Sky Club® memberships

- Car rentals through Delta

Miles can also be transferred through the SkyMiles portal to SkyMiles and SkyTeam partners, including Air France, KLM, Korean Air, LATAM, and more.

Related Article: The Ultimate Guide to Delta Air Lines SkyMiles

Variable Annual Fees

The SkyMiles Debit Card features an annual fee – but what that yearly charge is depends on the balance you maintain with your SunTrust Advantage Checking account.

SunTrust offers three tiers to its Advantage checking: Advantage, Advantage Choice, and Advantage Preferred. These tiers are based on the minimum account balance, with Advantage requiring up to $25,000 in balances, Choice requiring between $25,001 and $100,000, and Preferred over $100,000 in total checking account balances.

These tiers also feature different annual fees, either $95, $75, or $25, respectively. Regardless of your account status, however, the annual fee for the SkyMiles Debit Mastercard is waived for the first year.

Other Card Features

Other features of the SunTrust Delta SkyMiles® Mastercard Debit Card include:

- World Mastercard Hotel Stay Guarantee: If your 3-star or higher-rated hotel is not working out, a Lifestyle Manager will work to make it right.

- Lowest Hotel Rate Guarantee: If you find the same exact hotel stay for less, Mastercard will refund the difference.

- Access to Mastercard Luxury Hotels & Resorts

- Access to Mastercard Airport Concierge™ (additional charges apply)

- Mastercard ID Theft Protection

- Zero Fraud Liability

Should You Apply for the SunTrust Delta SkyMiles® Debit Card?

There are plenty of credit cards that earn airline miles, but very few co-branded debit cards for travel enthusiasts. The SunTrust Delta SkyMiles® Debit Card is a unique product that provides great value for SunTrust (now Truist) customers who want to augment their SkyMiles credit cards, or simply wish to avoid credit cards but still want to earn miles on everyday purchases.

The card doesn’t earn impressive miles, but it earns enough to justify keeping in your wallet – especially if you meet the eligibility requirements for SunTrust Advantage Choice or Advantage Preferred. Regardless of the account status, however, the card can help you earn SkyMiles on regular charges that credit cards can’t cover – things like rent, mortgages, or other similar payments.

Ultimately, the Delta SkyMiles® Debit Card from SunTrust is an intriguing – but niche – product that will appeal to some, but not all. For those customers, however, it offers impressive value – especially with its simple sign-up bonus.

Browse Other Card Offers:

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.