by Cory Santos | Last updated on February 13th, 2024

GoHenry Card

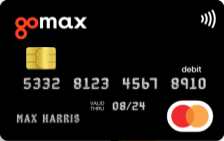

GoHenry Card

GoHenry Card

At a Glance

The GoHenry card is a debit card created for kids and teens to start learning and taking control of their finances. Designed for both children and parents to be involved in setting goals, controlling spending, and building good habits, it also features benefits such as setting chores and managing a savings account.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Flexible parental controls such as setting spending limits and being able to choose where the child's card is used

- Chores can be set up in-app and checked off when they're completed

- The GoHenry app offers a savings account option where savings goals can be set by cardholders and parents can lock and unlock

- Real-time updates via the app to know when, where, and how much children are spending

- All accounts are FDIC-insured with no risk of overdraft

- Minimum Deposit Required: $2.00

- You have children or teenagers and are interested in teaching them about how to manage their finances and budget effectively

- You want a card where you can control your kids' spending and allowance

- You're interested in setting up a savings account for your child with flexible goals and target dates

- You want to reward your kids for completing chores via a streamlined banking app experience

In-Depth GoHenry Card Review

The GoHenry debit card and associated financial literacy app is a prepaid debit card and allowance/chore app for teens and parents. The money management system makes learning about money fun by providing a slew of engaging and interactive tasks.

Who Is GoHenry for?

When you see a debit card, you might assume that GoHenry is another in the long line of debit cards with catchy names but very little else. Not so with GoHenry, however. GoHenry is a new debit card designed to help teach kids about finances.

Designed for Kids of All Ages

The GoHenry app isn’t just for teens. The program is crafted with kids aged 6 through 17 in mind, with unique materials and guides for each age range. This broad age range highlights the effectiveness of the GoHenry program, as it is designed to grow with your kids.

The app provides everything a parent would want from a bank for kids. GoHenry teaches kids and teens how to be independent and smart with money by helping them track their spending, budgets, savings goals, and more—all with support and guidance from parents.

How Does GoHenry Work?

Here’s a quick list of the features of GoHenry:

| Savings | Checking | Direct deposits | Split pay bill pay |

| Money Missions | Educational videos | Financial literacy articles | Set goals |

Teach Financial Responsibility with Money Missions

The GoHenry app stands out from the rest thanks to its impressive interactive content. Kids learn financial literacy and responsibility thanks to beautifully designed visuals, engaging videos, and easy-to-digest articles to boost their financial skills.

Kids also have access to “Money Missions.” These missions are side quests for your kids, with badges, points, and other rewards helping them advance through the game’s levels. Even better, these missions are specially designed by educators and financial experts. Money missions are crafted to meet K -12 Personal Finance Education National Standards.

Full Parental Controls

What’s great about GoHenry is its full slate of parental controls. Parents have access to not only the automated allowances and chore funding found with other apps but also the ability to set limits by three metrics: day, week, and month. Parents can also block merchants or spending categories and apply spending limits for purchases and ATM withdrawals.

GoHenry lets parents add a second parent to get notifications and manage the chore lists. This great feature lets parents cooperate and monitor their kids’ financial journey in real-time.

Choose from 45+ Card Designs

Like other debit cards for kids, GoHenry offers many card designs. Kids have more than 45 designs to select from, with collaborations, sports, and other cool designs. Remember that selecting a premium card design costs a one-time fee of $4.99.

Equally cool is the ability to add your name to the card design. While the card uses the name “GoHenry,” your child’s card will have their first name (GoJohn, GoLisa, etc.). That is an additional layer of design that will turn heads at school.

Other Card Features

Other notable features of the GoHenry app for kids include:

- FDIC-insured accounts up to $250,000

- Real-time spending notifications

- Chip and PIN-protected transactions

- Secure PIN recovery in the app

- Bank-level encryption

Kids also enjoy Mastercard debit card protections, including:

| Mastercard Global Service | Mastercard ID Theft Protection™ | Zero Liability Protection | Mastercard Airport Concierge™ |

What Does GoHenry Cost?

As with other kids’ debit card programs, GoHenry has associated fees. Plans start at $4.99 per month, with a 30-day free trial available. That $4.99 fee ($59.88 per year) is for one account only. Fortunately, families with multiple kids don’t need to shell out multiple monthly subscriptions. GoHenry offers a family tier, with up to 4 kids covered for only $9.98 monthly ($119.76 per year) – a great savings.

Fee Schedule

| Fee | Charge |

|---|---|

| Monthly fess | $4.99 ($9.98 for family plan) |

| Transaction fee | $0 |

| Cash reload fee | $0 |

| Transfers | $0 |

| ATM balance inquiry fee | $0 |

| ATM withdrawal fee | $0 |

| Card purchase | $0 ($4.95 for premium designs) |

| Card replacement | $0 |

Allowance App Comparisons

| Greenlight | Current | GoHenry | BusyKid | |

|---|---|---|---|---|

| Cost | from $4.99 per month | $36 per year | $9.98 per month | $4 per month |

| Kids per account | 5 | 1 | 4 | 4 |

| Account features | Educational app, savings, parental controls, optional investment platform | Savings, parental controls, educational tools | Flexible parental controls, savings, Split pay bill pay, Money Missions, education tools | BusyPay, APEF-approved educational tools, investment platform, savings, some parental controls |

| Network | Mastercard | Visa | Mastercard | Visa |

What We Like About GoHenry

Let’s Kids Own Their Financial Growth

The GoHenry debit card offers several benefits for young people in their journey towards financial independence. Firstly, it gives them a sense of ownership and responsibility over their finances. Having their debit card lets kids and teens learn about budgeting, saving, and making spending decisions. They can track their expenses, understand the concept of saving for goals, and learn the value of money through hands-on experience.

Learn Financial Skills

Secondly, GoHenry helps young people develop essential skills such as financial planning, budgeting, and self-control. With the ability to set savings goals and allocate funds accordingly, youngsters can learn how to prioritize their spending and make informed choices. This valuable experience will lay a strong foundation for their future financial well-being.

GoHenry promotes financial independence by gradually introducing young people to the banking world. Through the GoHenry app, they can view their account balance, track their spending, and even earn pocket money through tasks assigned by their parents. This exposure to banking concepts and tools prepares them for a seamless transition into the adult financial world.

Things to Consider

Monthly Fee

While GoHenry offers numerous benefits, it is also important to consider its drawbacks. One potential downside is the associated fees. GoHenry charges a monthly subscription fee, which may be a deterrent for some families. It’s critical for parents to carefully evaluate these costs and determine if the benefits outweigh the fees.

Tech-Forward Approach

Another drawback to consider is your potential reliance on technology. GoHenry is primarily an app-based service, and while this offers convenience and real-time tracking, it also means that youngsters need access to a smartphone or tablet. GoHenry may not be the most suitable option for families without reliable access to technology.

GoHenry Ratings

Are the GoHenry card and app right for your family? Here is a selection of expert ratings for the service:

| BestCards | Better Business Bureau | TrustPilot |

|

4.5/5 |

2/5 |

4.5/5 |

Should You Apply for the GoHenry Mastercard Debit Card for Teens?

So, is GoHenry the answer to your financial education concerns? If you have multiple children, yes. The platform and allowance app are intelligently designed and attractive, ensuring kids stay engaged. Adding Money Missions is another great feature, as it focuses on fun and games – and not mundane and boring money lessons.

Parents have a lot to like about GoHenry, too. The app interface has parents in mind and provides a full suite of tools to monitor your child’s spending (and earnings) to make sure they aren’t spending their money irresponsibly. These tools make it simple to teach kids financial lessons quickly and keep them engaged for years to come.

Browse Other Offers

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.