If you find that your current line of credit has grown a bit small for your spending, requesting an increase to your credit limit might be in order. It’s a process that sounds simple enough, and sometimes it is, but requesting an increase can have multiple consequences on your financial standing – both positive and negative. In addition to having a legitimate reason for getting an extension, you must also have the timing right, and you should be aware of how your overall credit is impacted.

Before Your Request an Increase

Meeting the Eligibility for a Credit Line Increase

It’s possible to receive a credit increase if you simply call your issuer out of the blue, but it pays (no pun intended) to be prepared before you pick up the phone. Review the following factors ahead of making your request:

- Your account’s standing: It should go without saying that the credit account you want an increase for should be as spotless as possible, with on-time payments and balances kept low, if not at zero. You’re trying to show that you’re responsible enough borrowing money that having access to a higher amount won’t pose a risk for the issuer.

- Income: Your income should complement the level of spending available to you. Requesting a credit increase if you’ve recently lost your job or downgraded your current post tells the issuer that you want more spending power with no realistic means of paying back what you owe.

- Your credit history: Expect to have a harder time being approved for an extension if your credit report is stained with negative information. Open accounts with high balances or those that have gone into collections are all items that affect your credit score and give a bleak impression of you to credit card issuers, and they won’t want to risk their money with someone who likely won’t pay it back.

- Credit utilization: How much of your current credit are you already using? If you often knock at your limit’s door, but you pay off your balance on time and in full, then it’s certainly reasonable to ask for an increase. If you’re still chipping away at a purchase you made several months ago and only paying the minimum monthly payments though, it might be best to reevaluate your spending before making the call.

Do You Want or Need to Increase Your Credit Limit

This should be the first question you ask yourself before even planning to contact your card issuer. Is the higher credit limit and extra spending power necessary or simply a commodity you’d like to have just in case you happen to buy more things?

Asking for a credit increase because you want to spend more money – and not thinking about the long-term effects of more spending – isn’t just short-sighted, it’s also irresponsible. If you now have more necessary expenses – be it for your business, your children, your home, or your day-to-day life – you should ask for an increase because all factors indicate that you need one.

If you’re using your credit card for more casual pursuits such as purchasing clothes, traveling, or dining at gourmet restaurants, there’s no harm in phoning your issuer as long as your funds can pay off any balances your rack up. You must first be able to justify – to yourself, at the very least – an increase before you say the words to your issuer.

When (and When Not) to Request an Increase

If all signs point to you getting approved for an increase, you should also feel confident that it’s the right time to make the request.

Is your credit card account in top shape? Good. Is your credit history healthy? Great. Did you recently get a raise or move to a higher-paying job? Even better.

The opposite is also true regarding when you should wait or ditch the idea of an increase altogether. In addition, you should make sure that your account isn’t too new. Asking for a higher limit when you haven’t even had your card for six months will probably result in a denial. If you’ve recently requested increases for other lines of credit, you will want to let some time go by, as well.

How to Ask for a Credit Limit Increase

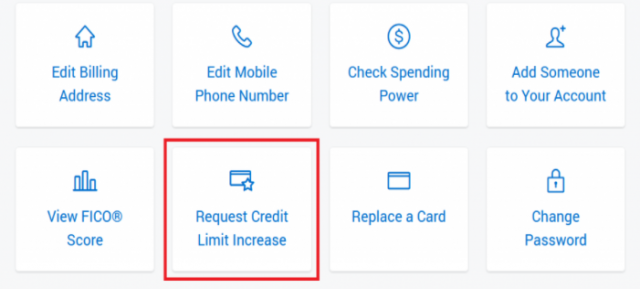

Asking your card issuer for a credit limit increase is a fairly straightforward process. Most issuers make the process available through their online site or through their mobile app – especially major issuers like American Express, Chase, Citi, Discover, and Capital One.

When you submit a request for a credit line increase, e prepared to provide the following information:

- Annual income

- Employment status and information

- Housing status (own/rent) and monthly payments

Other questions you might have to answer include proposed credit limit increase amount and reasons for requesting a credit increase.

If you don’t have access to the mobile app or website, you can also call a bank customer service reprensative to ask for your credit limit increase. Here are some of the customer service representative numbers for major issuers:

Keep in mind that credit line increases are not guaranteed. If your request fails, make sure to ask why, but be prepared to wait around eight months to a year before requesting another increase. In the meantime, keep credit utilization low – but don’t stop using your card.