Last updated on March 8th, 2023

FICO® is a familiar name. in credit and personal finance. But have you heard of VantageScore®, too? What are they, and what do they mean for consumers who want to open a line of credit?

FICO® vs VantageScore®: What's the Difference?

FICO and VantageScore are the two major general-purpose credit scoring models in the United States. They’re used by banks and credit card issuers to determine if an applicant for a credit card or loan should be approved. These models are based on software that analyzes a consumer’s personal credit report to generate a credit score. This score helps predict an important criterion for would-be candidates: The likelihood that an applicant will fall at least 90 days behind on a bill within the next 24 calendar months.

This prediction is the primary metric that banks use to approve or decline applications.

Both models help predict a consumer’s ability to repay both existing and future debt. Both evaluate multiple criteria when determining a consumer’s credit score. However, the way these two models treat the credit data used to determine this benchmark can differ. Let’s explore the differences between the two credit scoring models:

What is a FICO® Score?

The Fair Isaac Corporation (FICO®) introduced its first scoring model for lenders more than thirty years ago. Since 1989, 90% of the leading banks and card issuers have relied on FICO’s model when making lending decisions.

As of this writing, it is in its ninth iteration – the FICO Score 9 model. The FICO Score 10 model rolled out in the summer of 2020. This new model means updates to the predictive power of the FICO Score. It also brings more precision and flexibility with trended data.

A FICO Score groups the information provided by consumer credit reports into five categories, each of which is assigned a percentage of the total score:

- Payment History (35%) – Every lender wants to know if you pay your bills and past accounts on time. Paying accounts on time is a good indicator to a lender that you will continue this behavior. For this reason, this is the most important factor in a FICO score.

- Amounts Owed (30%) – Borrowers also look at the amount of money you currently owe from each of the existing accounts you already have. Owing money to multiple accounts won’t disqualify you from approval for a new loan or credit card. However, using too much of your available credit may indicate you are over-extended. Banks may interpret what they see as over-extension as a higher risk of default.

- Length of Credit History (15%) – A long credit history will often increase your FICO score. However, this will also depend on how your overall report looks. A long credit history that features several defaulted accounts will not work in your favor, for example. The opposite is also true. A person with a shorter credit history can still have a high FICO score if their credit report looks good. The FICO score evaluates several criteria for length of credit. These criteria include the average age of your accounts, when the last time an individual used each account, and more.

- New Credit (10%) – FICO evaluates how you shop for credit, in addition to the number of credit accounts you’ve opened. They look at the time frame during which you opened said accounts. Each time you apply for credit, the lender makes a credit inquiry – a request for your credit report or score. Each inquiry stays on your credit report for two years. FICO only considers inquiries from the last twelve months. Too many inquiries and opening several accounts in a short time can be a red flag for lenders.

- Credit Mix (10%) – This refers to the diversity of your credit file – your credit cards, retail accounts, installment and mortgage loans, and finance company accounts. The more accounts you have with good credit history, the better your FICO score will be. Credit mix is not typically a key factor in determining your FICO scores. However, if your file does not have a lot of other information, it can play a role in determining your score.

FICO is a bureau-specific scoring model. Each of the major credit reporting companies (CRCs) has their own FICO Score 9 model. FICO Score ranges from 300 to 850. 300 is poor credit, while 850 is considered “perfect” credit.

What is a VantageScore®?

The VantageScore model was developed by the three major consumer credit bureaus. It was created as a means to introduce a credit scoring model that is both more predictive and easier to apply and understand. Created in 2006, it went through several iterations before it debuted in 2013 as VantageScore 3.0. The 3.0 model became incredibly successful. Although there is now a VantageScore 4.0 model, 3.0 is still widely used by many major issuers, including Discover. VantageScore is the first and only credit scoring model to incorporate trended credit data from all three national CRCs.

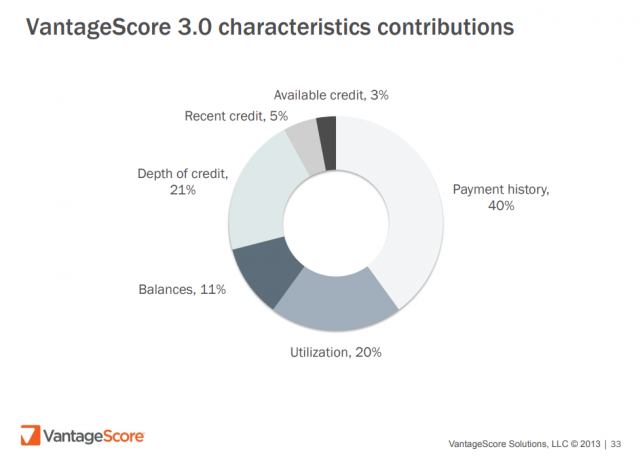

A VantageScore reflects the evaluation of information in six categories. Taken from a consumer’s credit file, this information is described in terms of influence. VantageScore’s descriptive terms usually range from “extremely influential” to “less influential.” However, they have released a breakdown of the factors they evaluate for VantageScore 3.0:

- Payment History (40%, or Extremely Influential) – VantageScore gives the most weight to whether a consumer has made on-time payments regularly in the past.

- Depth of Credit (21%, or Highly Influential) – This refers to a combination of factors like credit age and credit mix. Essentially, it is an evaluation of a consumer’s length of credit, as well as the types of credit they use.

- Utilization (20%, or Highly Influential) – Credit utilization is another factor that VantageScore marks as highly influential. Lenders look at the amount of available credit a consumer uses at any given time. If you are using a large percentage of your available credit (carrying a balance on multiple cards, for example), you may see a negative impact on your credit score. Credit experts recommend that consumers use 30% or less of their available credit at any time.

- Balances (11%, or Moderately Influential) – This factor considers the total of each recently reported balance. It includes both current and delinquent credit accounts.

- Recent Credit (5%, or Less Influential) – VantageScore also looks at the number of new accounts you’ve opened. Whether you’ve taken out a loan or opened a new credit card, lenders want to know. This information can be an indicator of future financial performance.

- Available Credit (3%, or Less Influential) – Lenders want to see that you’re not taking out more credit than you actually need. According to VantageScore, the average amount of unused credit for prime consumers ranges from $20,000 to $22,000.

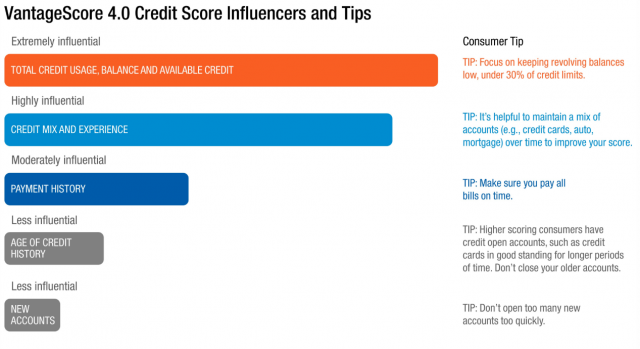

For VantageScore 4.0, the scoring has received an update. Note that this newer scoring system does not apply as universally as 3.0. Here’s a preview of the how each metric is weighted for VantageScore 4.0:

As a tri-bureau model, it can be used with a credit report from Experian, TransUnion or Equifax. VantageScore currently ranges from 300 to 850. 300 is poor credit, 850 is “perfect” credit.

Differences Between FICO® and VantageScore

There are several distinctive differences between the FICO® Score and the VantageScore models when it comes to evaluating credit. Both models prove useful, particularly for lenders – and both models produce scores that are easy for consumers to obtain. What sets them apart from each other?

Firstly, a limited credit history does not prevent a consumer from obtaining a VantageScore. FICO requires at least six months of credit history, while VantageScore can produce a score within two months or less. Consumers whose lack of credit results in no FICO score can still get a VantageScore.

Another differentiating factor is how the two models weigh late payments. The type of late payment becomes a factor here. All late payments can damage your score. However, VantageScore gives higher significance to late mortgage payments, while FICO treats all late payments the same.

Each time you apply for a loan or a credit card, a hard inquiry hits your credit file. A hard inquiry can lower your credit score, and multiple inquiries are a red flag for lenders, too. When evaluating consumers’ credit files, both FICO® and VantageScore de-duplicate these inquiries. De-duplication occurs when multiple inquiries count as one inquiry.

A good example of this would be an auto loan. An auto loan application often goes to multiple lenders. This leads to multiple inquiries within a short time period. Both scoring models de-duplicate this, although the time span they use for de-duplication differs for each. FICO uses a 45-day span, while VantageScore limits its focus to a 14-day range. Additionally, FICO de-duplicates only mortgages, auto loans, and student loans. VantageScore de-duplicates multiple hard inquiries for all types of credit, including credit cards.

Finally, FICO and VantageScore both penalize accounts that are sent to collection, although they handle them differently. The amount of the balance is important, as well as whether it’s been paid off or not. FICO does not count collections where the original balance was under $100, and it also discounts collections that have been paid off. These will not affect your FICO score, and VantageScore only ignores paid collection accounts. Accounts with a balance of less than $100 will be penalized by VantageScore once sent to a collection agency.

Related Article: Credit Card Application Rules for Major Banks

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.