Tips for Handling Last-Minute Holiday Expenses

Concerned about holiday spending getting out of control? Here are the experts’ top tips for handling last-minute holiday expenses.

Concerned about holiday spending getting out of control? Here are the experts’ top tips for handling last-minute holiday expenses.

Learn to protect yourself against online scammers and hackers. Follow these cybersecurity tips for online holiday shopping. Learn more.

Coordinating your business can help run things smoothly. Consider these tips to stay organized with your business’ finances.

Citi Entertainment® is an online portal full of entertainment possibilities. Here’s how you can use your Citi credit card to gain access.

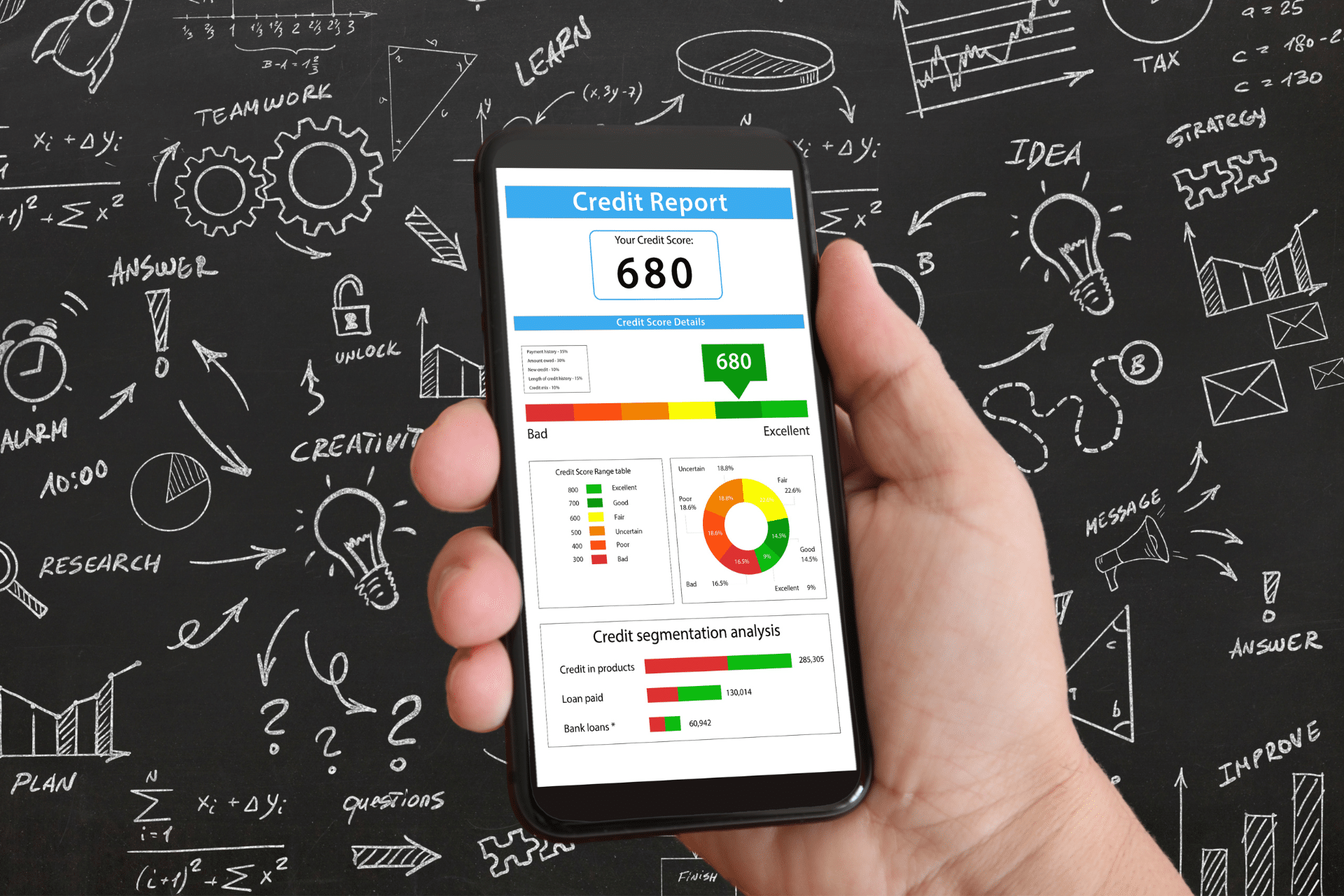

Your everyday essential purchases can help grow your credit score through the responsible use of a credit card. Learn more.

Learn how to choose a student credit card and find the best one for your needs as you start to build your credit history while in college.

Travel credit cards offer lucrative travel-related rewards. Is a general travel card good for your spending habits, or a co-branded travel card? Find out!

If you want the feeling of traveling abroad this summer while saving a ton of money, a budget-friendly staycation may be the answer.

Learn more about how credit card debt may affect your credit score and gain the confidence you need to manage your finances.

Here are four ways you can stay educated on financial literacy for improved skills on savings, budgeting, and investing. Read more.

The current inflation rate for May 2023 stands at a high 4.9%. Consider these money management tips for inflation this year Read more.

Looking for tips for how to get the most out of your team’s business credit cards? Here are 5 easy tips you can tackle today!