What are Your Credit Card Points Worth?

Ever wondered what your credit card points are worth? Here are the latest credit card point values from BestCards:

Ever wondered what your credit card points are worth? Here are the latest credit card point values from BestCards:

Looking to get the most out of your Bilt Rewards? Earn double points and more with Bilt Rent Day – here’s how!

Learn how to protect yourself from becoming a victim of credit card fraud. Follow our pro-tips to ensure that your information is always secure.

Don’t let your credit card debt keep you from planning your dream wedding. Here’s everything you need to know to make your special day magical on a budget.

Millions are falling behind as America’s continuing credit card debt problem. Here’s how you can tackle debt during a financial crisis.

Travel doesn’t have to be tricky. Here are some top tips for managing travel expenses with credit cards for beginners.

While there are many resources available online to keep you educated on credit card use, you may stumble upon a few myths. Let’s debunk them. Read more.

What are the pros and cons of shopping with a store credit card? Keep reading for a deep dive into retail credit cards.

Keep track of your financial habits, including the ones that improve your credit score. Avoid these 10 habits for better credit. Learn more.

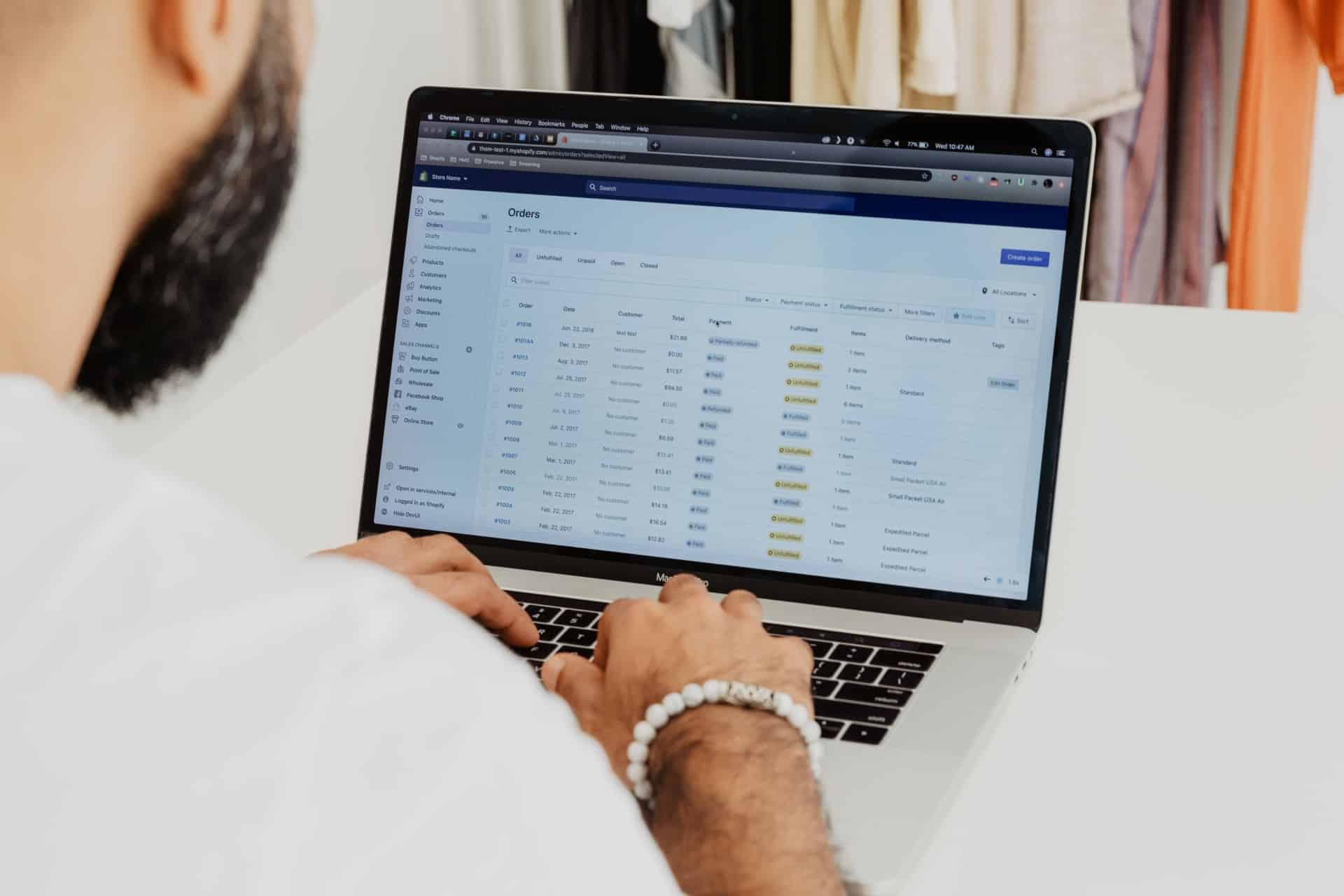

Not every purchase should go on a business card. Here are 5 transactions to avoid putting on business credit cards. Read more:

There is an overwhelming amount of travel credit cards to choose from so how do you know what to look for? Here is how to choose one. Read more.

Wondering what credit card concierge services are all about? Read our ultimate guide to everything concierge-related and find out!