Filter Options

×-

-

Unselect all

-

Unselect all

-

Unselect all

Showing 549 Cards

Sort By Column Name:

Wells Fargo Autograph Journey Visa® Credit Card

Wells Fargo Autograph Journey Visa® Credit Card

- 21.24%, 26.24%, or 29.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 21.24%, 26.24%, or 29.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The Wells Fargo Autograph Journey Card provide a lucrative earning platform for travelers who want the freedom to book travel on their terms and not based on a bank's travel portal. The card earns up to 5X points on travel purchases, offers points transfers to leading carriers and hotels, and comes with a slate of tarvel credits and benefits for a modest $95 annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- $50 annual airline statement credit

- No foreign transaction fees

- Earn 5X points on hotels, 4X on airlines, and 3X on travel and dining purchases

- Earn 1X points on all other purchases

- Transfer points to leading loyalty programs

- Regular Purchase APR: 21.24%, 26.24%, or 29.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 21.24%, 26.24%, or 29.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Introductory fee of either $5 or 3% of the amount of each balance transfer, whichever is greater, for 120 days from account opening. After that, up to 5% for each balance transfer, with a minimum of $5

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each advance, whichever is greater

- Annual Fee: $95

- Late Payment Penalty Fee: Up to $40

- You already bank with Wells Fargo

- You want a lucrative travel credit card without needing to book in restrictive travel portals

- You don’t want to pay any foreign transaction fees

- You can make use of the $50 annual credit

U.S. Bank Business Altitude™ Power World Elite Mastercard®

U.S. Bank Business Altitude™ Power World Elite Mastercard®

- 20.24% to 28.24% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 20.24% to 28.24% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The U.S. Bank Business Altitude™ Power World Elite Mastercard® is a business rewards card for that earns up to 2.5X points on eligible purchases with mobile wallets, with no foreign transaction fees and a $0 introductory annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 6X points on on hotels and car rentals booked in the U.S. Bank Rewards Center

- 2.5X points on up to $5,000 in mobile wallet purchases each quarter

- 2X points on all other purchases

- No foreign transaction fees

- Regular Purchase APR: 20.24% to 28.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 20.24% to 28.24% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either 3% of the amount of each transfer or $5 minimum, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either 5% of the amount of each advance or $10 minimum, whichever is greater

- Penalty APR: 32.49%

- Annual Fee: $195

- Late Payment Penalty Fee: $40

- Return Payment Penalty Fee: $40

- Over Limit Penalty Fee: $40

- Your company spends heavily on mobile wallet purchases

- You plan to issue multiple employee cards to maximize rewards

- You want to streamline your bonus categories

- You spend enough on to justify the annual fee

Universal Rewards Visa Signature®

Universal Rewards Visa Signature®

- 21.99% to 28.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 21.99% to 28.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 28.99% variable based on the Prime Rate Cash Advance APR

- 0% for 6 months from account opening date Intro Purchase APR

At a Glance

The Universal Rewards Visa Signature® Card is a no frill rewards card that earns 2% back on eligible Universal purchases, 1% back on all other purchases, and more - for a $0 annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 2% back in rewards on qualifying Universal purchases

- 1% back on all other purchases

- 10% ff select merchandise, food and beverage purchases

- No annual fee

- Intro Purchase APR: 0% for 6 months from account opening date

- Regular Purchase APR: 21.99% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 21.99% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 28.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $15 or 5% of the amount of each cash advance, whichever is greater

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $35

- You love theme parks but prefer Universal Studios

- You don't want to pay an annual fee

- You want basic cash back rewards on everyday purchases

Universal Rewards Plus Visa Signature®

Universal Rewards Plus Visa Signature®

- 21.99% to 28.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 21.99% to 28.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 28.99% variable based on the Prime Rate Cash Advance APR

- 0% for 6 months from account opening date Intro Purchase APR

At a Glance

The Universal Rewards Plus Visa Signature® Card offers up to 4% cash back on Universal purchases, plus provides 10% savings on eligible purchases within the park. Cardholders also enjoy special 0% APR financing for 6 months and more for a $99 annual fee.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn 4% back in rewards on qualifying Universal purchases

- 2% back in rewards on Travel, Gas and Dining purchases

- Earn one single day theme park general admission ticket each account anniversary

- $99 annual fee

- Intro Purchase APR: 0% for 6 months from account opening date

- Regular Purchase APR: 21.99% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 21.99% to 28.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 28.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $15 or 5% of the amount of each cash advance, whichever is greater

- Annual Fee: $99

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $35

- You love theme parks but prefer Universal Studios

- You plan to keep the card year-after-year to take advantage of the single-entry reward

- You want basic cash back rewards on everyday purchases

TAP Miles&Go American Express®

TAP Miles&Go American Express®

- 21.24% to 28.24% variable based on creditworthiness and the Prime Rate Regular Purchase APR

At a Glance

The TAP Miles&Go American Express® credit card is the ideal travel companion for anyone who want premium travel perks but hate paying a steep annual fee of hundreds of dollars. The card, from Cardless, charges $79 per year but grants perks like lounge access, preferred boarding, and more.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- No foreign transaction fees

- Earn 60,000 miles after spending $2,500 in purchases in the first three months

- Earn 3X miles on TAP Air Portugal purchases

- Earn 2X miles on dining, plus rideshares, taxis, and public transit

- Earn 1X miles on all other purchases

- Two complimentary TAP lounge passes each year

- Preferred boarding on TAP-operated flights

- Regular Purchase APR: 21.24% to 28.24% variable based on creditworthiness and the Prime Rate

- Annual Fee: $79

- Late Payment Penalty Fee: Up to $30

- Return Payment Penalty Fee: Up to $30

- You travel to Portugal, Europe, or other similar destinations often

- You prefer to fly with TAP Air Portugal or other Star Alliance airlines

- You want access to premium perks like airport lounges and upgrades

- You plan to spend at least $2,500 in the first three months

Xbox Mastercard

Xbox Mastercard

- 20.99%, 26.99% or 31.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 20.99%, 26.99% or 31.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 32.49% variable based on the Prime Rate Cash Advance APR

At a Glance

The Xbox Mastercard is an interesting retail credit card from Barclaycard. The card earns an impressive 5X points on eligible Microsoft purchases, 3X on streaming and dining, and 1X on everything else. New accounts also enjoy a decent point bonus and free trial of Xbox Game Pass Ultimate just for using the card.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- No annual fee

- Earn 5X points on eligible Microsoft or Xbox purchases

- Earn 3X points on select streaming and dining

- Earn 1 point per $1 spent on all other purchases

- Regular Purchase APR: 20.99%, 26.99% or 31.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 20.99%, 26.99% or 31.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 5% of the amount of each transaction, whichever is greater

- Cash Advance APR: 32.49% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater

- Foreign Transaction Fee: 3% of the transaction amount in U.S. dollars

- Late Payment Penalty Fee: Up to $41

- Return Payment Penalty Fee: Up to $41

- You prefer Xbox as your gaming platform

- You're considering buying a new Xbox console and want to earn points on it

- You want a stylish card that shows your love for your favorite game series

- You don’t want to pay an annual fee

Target RedCard™ Mastercard

Target RedCard™ Mastercard

- 28.15% variable based on the Prime Rate Regular Purchase APR

- 31.15% variable based on the Prime Rate Cash Advance APR

At a Glance

The Target RedCard™ is a family of credit, debit, and prepaid cards from Target and TD Bank, with the most interesting option the no annual fee Target RedCard™ Mastercard. The card offers 5% off on Target purchases, plus 2% cash back on gas and dining, and 1% back on everything else.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Unlimited 5% savings at Target and Target.com

- 2% cash back on dining and gas station purchases

- 1% back on all other purchases

- Additional 30-day return policy on select items

- 2-day delivery

- No annual fee

- Regular Purchase APR: 28.15% variable based on the Prime Rate

- Cash Advance APR: 31.15% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 3% of the amount of each cash advance, whichever is greater

- Late Payment Penalty Fee: Up to $41

- Return Payment Penalty Fee: Up to $30

- You primarily shop at Target for your groceries or household items

- You want basic rewards for gas and dining purchases

- You have a good or excellent credit score

- You want a card with no annual fee

Square Credit Card

Square Credit Card

- See Terms Regular Purchase APR

At a Glance

The Square Credit Card is an invite-only business credit card for Square sellers and works in synchronicity with Square’s financial management tools and savings. It features no annual fee, free processing rewards, and an easy application process. Square Inc. is a company that offers payment services to businesses of all sizes. Its recent addition, the Square Credit Card, features zero fees and a streamlined platform to manage your business budgets.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- See if you qualify without harming your credit score via an easy application process

- Integrates seamlessly with other Square services for easier card management

- Zero fees - never pay a fee for late payments, annual renewals, or anything else

- The cards rewards system is designed to earn cardholders free processing fees

- Credit limits are based on sales processed through Square so you'll have access to the right amount of cash

- Confidently use the sleek metal card equipped with fraud protection and automatic repayment options

- Regular Purchase APR: See Terms

- You're already a Square seller looking to streamline your business money with credit

- You want to earn free Square processing as a reward for using your Square Credit Card

- You want the peace of mind of paying zero fees on your business credit card

- You don't mind a credit limit based on your Square sales

Citizens Private Client™ World Elite Mastercard®

Citizens Private Client™ World Elite Mastercard®

- 18.99% to 26.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 18.99% to 26.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The Citizens Private Client™ World Elite Mastercard® provides Citizens Banks best cash back rewards and more. Earn 2% back on all purchases and enjoy lounge access, priority security, and more.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn an unlimited 2% back on all purchases

- No annual fee with a Citizens Private Client™ account

- No foreign transaction fees

- TSA Precheck or Global Entry statement credits

- Priority Pass Select

- Regular Purchase APR: 18.99% to 26.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 18.99% to 26.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $10 or 5% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 3% of the amount of each cash advance, whichever is greater

- Annual Fee: $195 ($0 for Citizens Private Client™ clients)

- Late Payment Penalty Fee: $41

- You want to earn 2% back on all purchases

- You are an existing Citizens Private Client™ client

- You plan to travel and make use of lounge access

- You want TSA Precheck or Global Entry to speed through airport security

Fifth Third Preferred Cash/Back Card

Fifth Third Preferred Cash/Back Card

- 20.49% to 29.99% variable based on creditworthiness and the Prime Rate Regular Purchase APR

- 20.49% to 29.99% variable based on creditworthiness and the Prime Rate Balance Transfer APR

- 29.99% variable based on the Prime Rate Cash Advance APR

At a Glance

The Fifth Third Preferred Cash/Back Card is Fifth Third's best cash back rewards credit card. The card earns an unlimited 2% cash back on all eligible purchases, with no caps, annual fee, or foreign transaction fees.

- Best Benefits

- Rates & Fees

- Why Should You Apply?

- Earn an unlimited 2% back on all purchases

- No annual fee

- No foreign transaction fees

- Redeem rewards for statement credits, deposits, or a check

- Regular Purchase APR: 20.49% to 29.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer APR: 20.49% to 29.99% variable based on creditworthiness and the Prime Rate

- Balance Transfer Transaction Fee: Either $5 or 4% of the amount of each transfer, whichever is greater

- Cash Advance APR: 29.99% variable based on the Prime Rate

- Cash Advance Transaction Fee: Either $10 or 5% of the amount of each cash advance, whichever is greater

- Late Payment Penalty Fee: Up to $40

- Return Payment Penalty Fee: Up to $40

- You currently have a Fifth Third Preferred Checking account

- You don't want to pay an annual fee or hidden fees

- You don't want to bother with a confusing rewards program and instead earn unlimited rewards on every purchase

You've viewed 5 of 549 credit cards

What Is an Excellent Credit Score?

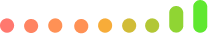

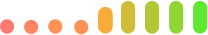

The definition of an “excellent” credit score can vary depending on the scoring model used. The two most popular scoring models, FICO and VantageScore, use slightly different calculations to determine what constitutes a good score and what is considered excellent.

What’s an Excellent FICO Score?

FICO is the most widely used credit scoring model by banks. It assigns scores on a range from 350 to 850, with anything above 800 considered “excellent.”

What’s an Excellent VantageScore?

VantageScore, although less popular than FICO, is also used to assess the creditworthiness and reliability of potential applicants. The three major credit bureaus developed it: Equifax, Experian, and TransUnion. VantageScore assigns scores ranging from 300 to 850, with scores over 781 being deemed “excellent.”

What are the Benefits of Having Excellent Credit?

Having an excellent credit score opens up a world of opportunities. It demonstrates to lenders that you are a responsible borrower and will likely repay your debts on time. With a high credit score, you can qualify for lower interest rates on loans, credit cards with better rewards and benefits, and even better insurance rates.

Also, a good credit score can make renting an apartment, getting a job, or even starting your own business easier. It is an essential financial tool that can significantly impact various aspects of your life.

Here are a few other benefits of having excellent credit:

Lower Interest Rates

Good and excellent credit can secure the best interest rates on credit cards and other loans. Individuals with excellent credit usually receive APRs around 4% lower than those with good credit and approximately 12% lower than applicants with fair credit. They may also qualify for lower balance transfer fees or no foreign transaction fees.

Rewards

Excellent credit often translates to better card offers with enhanced rewards in the form of cash back, points, or miles. The value of these rewards varies depending on the issuer, so it’s important to carefully review the terms and conditions of the rewards program before applying for a credit card to understand how points are earned and redeemed.

Credit Limits

A prime or super prime credit score can lead to approval for higher credit limits compared to individuals with average or poor credit. This advantage extends to other credit products such as auto loans, mortgages, and personal loans.

Perks

The best credit cards and charge cards for individuals with excellent credit come with exceptional perks. Luxury credit cards often offer travel benefits that surpass their annual fees, including hotel upgrades, dedicated concierge services, lounge access, Global Entry or TSA statement credits, and more.

How to Get an Excellent Credit Score

Getting the best credit scores requires patience and hard work. An excellent credit score doesn’t happen overnight. Instead, it takes years of good financial habits. The easiest way to build an excellent credit score is to follow these three simple steps:

| ① Check and review your credit reports | Ⓐ Check your credit reports from all three of the nationwide consumer reporting agencies: Equifax, Experian, and TransUnion. |

| Ⓑ Check for negative credit information, like potential fraud or ID theft, accounts in collection, or unpaid balances. | |

| ② Pay your bills on time | Ⓐ Automatic payments are a great way to avoid accidentally missing a payment. |

| Ⓑ Splitting monthly payments into two smaller payments can help stretch budgets while ensuring you pay on time. | |

| ③ Keep credit use low | Ⓐ Credit utilization accounts for roughly 30% of your credit score, so aim to keep credit use as low as possible. |

| Ⓑ Consider a balance transfer credit card if your credit use is creeping up and you want to consolidate that debt into one new account, typically at 0% Intro APR. | |

| ④ Limit new applications | Limit any new credit applications to only what is essential (i.e. if applying for a balance transfer credit card). |

| ⑤ Keep old accounts open | Don’t close any old, unused accounts. Closing accounts can lower your average credit utilization. |

Based on the information above, paying your bills on time is critical. Payment history is the most important factor in determining your credit score, making up over a third of your FICO Score. Try setting up bi-weekly payments so you can keep your credit use low.

Your credit utilization is how much you use compared to the available amount. Always try to keep your credit utilization below 30% of your available credit limit, though if you want to achieve excellent credit, it is better to aim for 10% overall credit use – or less.

How Long Does It Take to Achieve an Excellent Credit Score?

Building an excellent credit score takes time and consistency. There is no fixed timeline, as it varies depending on individual circumstances. However, with dedication and responsible financial habits, you can see improvements in your credit score within a few months to a year. Remember, your credit score reflects your financial behavior over time, so patience and persistence are key.

Tips for Maintaining an Excellent Credit Score

Once you have achieved an excellent credit score, it is essential to maintain it. Here are some tips to help you maintain your creditworthiness:

- Continue paying bills on time: Consistently paying your bills on time is crucial in maintaining an excellent credit score. Set up reminders or automatic payments to ensure you never miss a payment.

- Avoid unnecessary debt: While taking on additional debt, such as unnecessary loans or credit cards may be tempting, it is important to be mindful of your borrowing habits. Only take on debt that you can comfortably manage and repay.

- Monitor your credit: Monitor your credit score and credit report closely to identify any changes or errors promptly. This will allow you to take appropriate action if needed.

Conclusion

Achieving and maintaining excellent credit scores requires discipline, responsible financial habits, and patience. You can enjoy the benefits of excellent credit by understanding the factors that influence your credit score, regularly checking your credit report, and taking steps to improve and maintain a good credit score. Remember, good credit opens doors to better financial opportunities and helps you achieve your personal and financial goals.

Check out more

Excellent Credit Cards

Editorial Disclosure – The opinions expressed on BestCards.com's reviews, articles, and all other content on or relating to the website are solely those of the content’s author(s). These opinions do not reflect those of any card issuer or financial institution, and editorial content on our site has not been reviewed or approved by these entities unless noted otherwise. Further, BestCards.com lists credit card offers that are frequently updated with information believed to be accurate to the best of our team's knowledge. However, please review the information provided directly by the credit card issuer or related financial institution for full details.